Cache was founded to help tech employees make the most of their large stock positions.

As a former Uber employee, I personally experienced a gut-wrenching roller-coaster while the stock that made up most of my net worth moved up and down. I knew I had to diversify, but I was hit with giant tax bills every time I sold and reinvested.

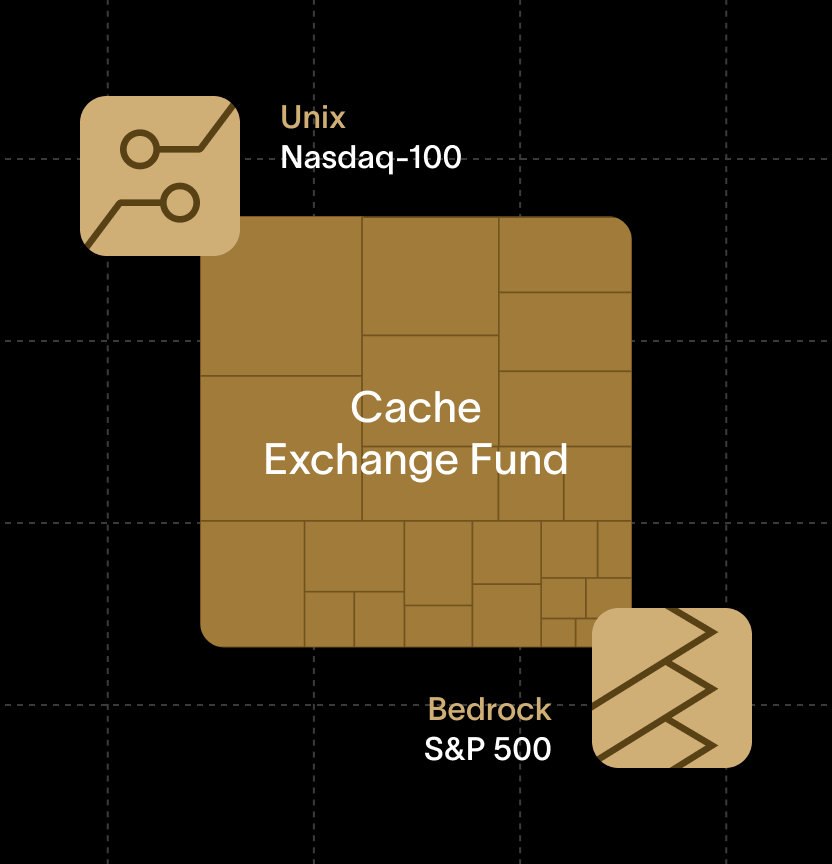

That’s when my financial advisor introduced me to exchange funds. They were a great solution for the situation I was in, but hardly any of my friends knew about them. Along the way, I found that there is a whole class of products for large stock positions that aren’t available outside of private wealth channels. I founded Cache to bring these powerful products to more investors with concentrated positions.

Like many other fintech companies, we are entering an age-old market. However, we have an advantage over traditional firms: A fresh start to build our products from the ground up with a technology-forward approach (and without decades of organizational inertia). Here’s what we built in the last two years:

- A modern brokerage platform for large stock positions, built by teams who’ve worked on world-class products at Robinhood, Uber, and Stripe.

- A robust financial foundation, working with the world’s largest custodian bank (BNY Mellon) and a market-leading clearing broker (Apex).

- A world-class investment team with deep experience managing exchange fund portfolios. Our team has decades of experience managing multi-billion dollar portfolios at Goldman Sachs, Eaton Vance, and others — including the largest exchange funds.

I'm especially proud of the thoughtful people and the investment experience we've brought together. Here’s an introduction to our talented investments team, their stories, and what drives their investing philosophies.

Meet the team

What excites you most about Cache’s future?

Christopher Lange: When I connected with our founder Srikanth and the team, I was instantly drawn to Cache’s innovative approach to addressing a very real investment dilemma: How to empower individuals with large, concentrated stock positions to effectively manage their portfolios, understand the risks and opportunities with their concentrated stock, and educate themselves to make informed, prudent investment decisions.

I knew how badly the investment industry needed to transition to technology-forward solutions. I was – and continue to be – amazed at the talent, focus, and skill Cache’s engineers are using to democratize this corner of the investment industry. Having worked at both a large investment bank and a boutique investment manager, I saw that Cache’s technology-forward approach offers a streamlined investment offering that’s unique within the industry.

I came to believe Cache is capable of doing more than others to address the dilemma confronted by investors with concentrated stock positions. For these reasons, I was excited to join to lead the investment effort, and I look forward to building upon what Cache has already set up.

Michael Allison: I agree with all of that! It’s a wonderful opportunity for Cache to approach this issue with a blank slate. We’re focusing on broadening accessibility to exchange funds. At the same time, we’re also able to focus on the stocks that have and should continue to have great growth potential. Bringing a more accessible option to the list of exchange fund providers is most fascinating opportunity of my career.

How did you get started in the industry?

Mike: As an undergraduate student, I did an independent study project where I programmed a bond calculator. I taught myself to program in the process. That project led to an internship with a boutique asset management firm, which in turn led to an opportunity with a larger asset manager, and ultimately to a 22-year career with Eaton Vance Management in Boston.

Christopher: I joined Goldman Sachs out of college, and I spent my formative investment years learning from some of the best investors in the business. Early in my career, it was a great place to learn about the importance of risk management, position sizing, and asset allocation, among myriad other considerations.

What should investors know about the people responsible for looking after their investments?

Mike: It’s important for investors to know that we have experience – not only in the investment management business but, more importantly, in the very specific realm of exchange funds. There aren’t many players in the industry. While Cache is a new entrant, our team brings decades of experience in the management of exchange funds.

Christopher: If there is one thing that has always stuck with me, it’s that managing portfolios means being a fiduciary for your investors. While investing requires taking risks and managing them appropriately, it is never far from my mind that I’m charged with making decisions that preserve (and deliver a return on) the capital someone has worked hard to earn. If we do our portfolio management job right, it should translate into a brighter future for our investors. I try to think about my role in those terms.

How is a fintech different from your other investment firms?

Christopher: I have worked for both large investment firms and boutique firms, and I think working for a fintech company combines the best of both worlds. We have access to all the data, tools, and portfolio management systems that much larger firms use. At the same time, our investment staff is lean, highly focused, and endowed with the investment experience and skills we need to excel at our mandate. I am thrilled every day to partner with Mike Allison as we think about how to build our portfolios.

Mike: Thanks for the kind words, Christopher! I’d add that the focus on the investor experience – front end to back end – is a big difference, too. We’re enabling investors with some amazing technology. Everything is so much easier and more transparent for them.

How does working for Cache present opportunities not available at your previous employers?

Mike: One of the most common conundrums in the corporate realm – and particularly in the asset management space – is the tension between growing through innovation while at the same time defending the existing base of business. With Cache, we have the opportunity to answer the question, “If you had a blank slate, how would you do it?”

I think we’ve already built a better mousetrap, so to speak, and I’m proud we’re able to introduce our Exchange Fund to a broader base of investors.

Christopher: It really is incredible. Our commitment to improving the experience for investors is such a refreshing change. From streamlining the investment process to accessing investment tools to digitizing onboarding and communications, Cache is totally different. We’re user-friendly, AND we offer sophisticated investment products.

What makes managing an Exchange Fund unique?

Christopher: Because individuals are contributing their stock in anticipation of holding for seven years or more, there is a lot of work upfront to ensure that all the contributed securities are carefully balanced to achieve the fund’s investment objectives. An exchange fund has limited rebalancing options, so we place extra emphasis on ensuring the portfolio at inception can stand on its own.

Mike: It’s an interesting challenge. In traditional portfolios, you get to select the stocks that come into the portfolio and adjust them over time. With an exchange fund, the portfolio manager is essentially a partner with the contributing investors. We seek to bring together a portfolio that benefits the greater whole by helping investors diversify and reduce tax drag together – while seeking strong returns.

Who are exchange funds designed for?

Mike: They can help investors with significant single-stock concentration risk to diversify their equity exposure in a tax-deferred manner. If that’s something you’re looking for, it can be a very effective vehicle.

Christopher: Each investor should take into account their specific situation, but the investment case for diversification is that it can help reduce risk. It also has the potential to increase returns in a lot of cases – check out our research on the subject.

If you’re an investor with a long time horizon, participating in an exchange fund can give you a diversified portfolio right away while pushing off the tax burden until later.

===

For anyone who wants to learn more, we’ve built an exchange fund simulator that shows the potential benefits of tax deferral. And we’d be happy to help you understand more about exchange funds and the other investments we offer. To get started, just tell us a little about your situation.

<p class="blog_disclosures-text">The purpose of this material is to inform, and it should not be considered an offer, solicitation of an offer, or advice to buy or sell securities or investment products. The investments mentioned may not be suitable for all clients. All investments involve risk. Before making an investment decision, each investor should carefully consider the risks associated with the investment, and make a determination, based upon their own particular circumstances, that the investment is within their investment objectives and risk tolerance. Keep in mind that while diversification may help spread risk, it does not assure a profit or protect against loss in a down market. There is always the potential of losing money when you invest in securities or other financial products. The rate of return on investments can vary widely over time, especially for long-term investments. Investment losses are possible, including the potential loss of all amounts invested, including principal. Any products discussed herein may be purchased only after a client has carefully reviewed the offering materials associated with each product.</p>

<p class="blog_disclosures-text">The Cache Exchange Fund is an alternative investment. Regulations require certain eligibility criteria for participation. Exchange funds are suitable only for eligible, long-term investors who are willing to forego liquidity and put capital at risk for substantial periods of time. Regulations require a minimum holding period to realize the potential advantages. They may also have higher fees than traditional investments. Tax counsel for Cache is of the opinion that investors who contribute appreciated stocks to the fund will not incur federal income tax liability. Tax laws might change. Clients should consult their own tax and legal advisors.</p>

<p class="blog_disclosures-text">Forward-looking statements (including estimates, opinions, or expectations about any future event) contained in these materials are based on a variety of estimates and assumptions by Cache. There can be no assurance that any such estimates and assumptions will prove accurate, and actual results may differ materially, including the possibility that an investor may lose some or all of any invested capital.</p>

{{black-diversify}}