When Cache launched its modern exchange fund in March 2024, we set out to challenge the status quo. For too long, exchange funds were mainly for the ultra-wealthy and required significant minimums and fees. We believed we could change that. With faster diversification, lower minimums, broader eligibility, and competitive fees, the Cache Exchange Funds opened the door to a powerful investment tool—one that was no longer reserved for the financial elite.

The industry took notice. Publications like Bloomberg, Barron’s, and Axios highlighted Cache as an innovative new entrant. Investors followed, and our mission to democratize exchange funds began gaining real momentum.

As we turn the page over to a new year, our 2024 results are in—and they speak for themselves. Cache Exchange Funds haven’t just met expectations; they’ve exceeded them. Through careful portfolio construction and thoughtful stock curation, our exchange funds have outperformed the Nasdaq-100 benchmark on both an absolute and risk-adjusted basis. Our funds held a majority of the outperforming stocks in the benchmark, while exposure to underperformers was less significant.

Cache Exchange Funds haven’t just met expectations; they’ve exceeded them.

Cache was founded in January 2022 and spent over two years in stealth mode, meticulously building the technical and financial infrastructure for its modern exchange funds. We also created a broker-dealer and an investment advisor and secured the necessary regulatory registrations.

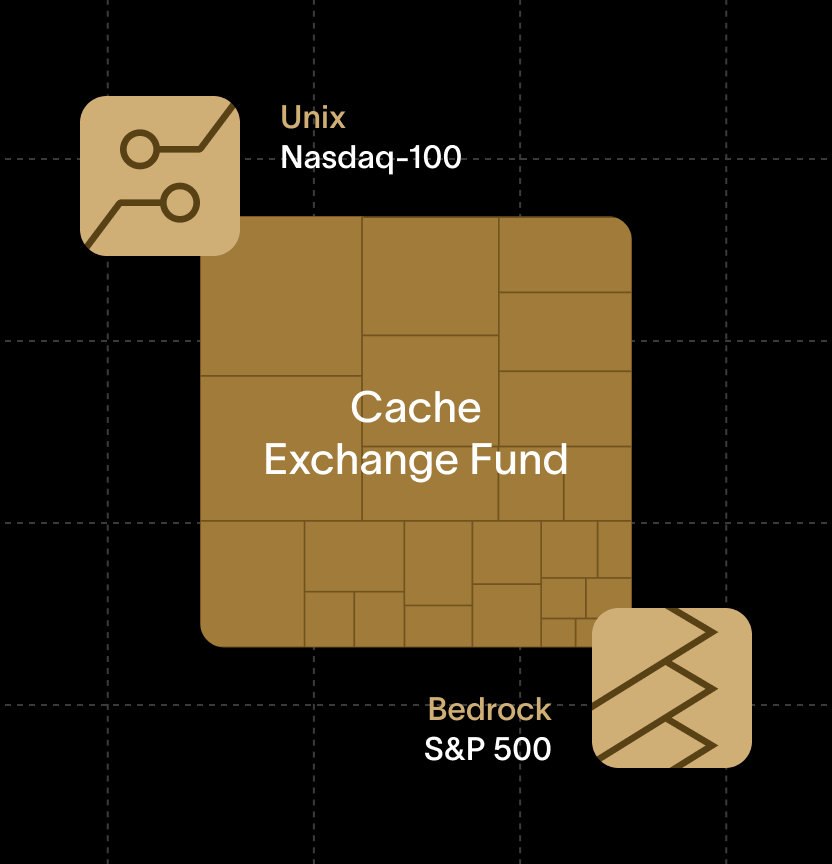

Our first fund, Cache Exchange Fund I, LLC, (CEF I) launched in March 2024, opening access to accredited investors and redefining what exchange funds could be. Strong investor demand quickly led to the creation of additional funds—GNU, Unix, and Fortran—each designed to meet the diverse needs of our growing client base.

In just three quarters since our launch, Cache Exchange Funds have surpassed $300 million in gross assets, a milestone that underscores the strength of our offering. Through the Cache Exchange Funds, our investors could defer more than $200 million in capital gains and benefit from tax-efficient diversification.

We were fortunate to attract a wide spectrum of early adopters. Sophisticated wealth management firms have diligenced our offerings and chosen Cache as a key solution for their clients. Whether you’re an early-career professional seeking diversification, a C-suite executive navigating concentrated stock positions, or a family office seeking efficient strategies, Cache has served investors just like you.

Performance Overview

In 2024, all three Cache Exchange Funds delivered significant outperformance relative to the Nasdaq-100 benchmark, exceeding it by 7.7% to 10.9%.

Absolute outperformance

Our first and longest-running exchange fund (CEFI) returned 25.1%, compared to 17.4% for the Nasdaq-100 over the same period, representing a +7.7% outperformance, since inception on March 8th 2024 net of fees. Other funds launched later in the year have shown similar results over shorter timeframes.

Higher risk-adjusted returns

In addition to absolute returns, Cache Exchange Funds also delivered better risk-adjusted performance, measured using the Sharpe ratio. Each of our funds had a higher Sharpe ratio than the benchmark during the same period.

Focus on risk management

Risk management is at the core of Cache’s portfolio construction. Each exchange fund attempts to quantitatively approximate the benchmark’s returns through selective onboarding, with a goal to maintain a 2%- 4% annualized tracking error. Over the past year, realized tracking error has been 3.8%- 3.9%, reflecting disciplined execution—even when it meant turning away many investors.

This result indicates that our portfolio construction and risk management processes are working as intended. Our realized performance upside should create a potential tailwind for future years.

Favorable Stock Selection

Across our funds, exposure to top-performing stocks in the index significantly enhanced returns over the last year. The Cache Exchange Funds also had exposure to more of the top-performing names in the Nasdaq-100 Index than the worst-performing names.

- Top-Performing Stocks: Cache Exchange Funds held on average more than half of the top 25 stocks in the Nasdaq-100 (representing 55.2% of the index weight). Among the top five performers, we had exposure to AppLovin, Palantir, Nvidia, and Axon, with only MicroStrategy excluded.

- Worst-Performing Stocks: Of the 25 worst-performing stocks, our funds held under 5 of the worst performers (representing 3.5% of the Nasdaq-100 assets.) Among the bottom five, we had no exposure to Intel, Biogen, Dexcom, or Pinduoduo, only having exposure to MongoDB.

An important note: these holdings do not represent all of the stocks selected for the Cache Exchange Funds, and past performance does not guarantee future results.

Lastly, all of our funds held Apple, Nvidia, Alphabet, Meta, Microsoft, Amazon, and Tesla among their top 10 holdings (collectively known as “the Magnificent Seven” — a lineup comprising some of the world's largest and most influential companies today).

Ready to start the new year by taking a step towards a healthy portfolio tax-efficiently? Our next close is on Feb 14th. Explore if you are a match.

<div class="blog_disclosures-text">Fortran refers to Cache Exchange Fund Fortran, LLC, Cache’s newest Exchange Fund open to accredited investors. Fortran is a newly launched fund that plans to hold its first closing on Feb 28, 2025 and does not have an investment track record listed. The performance of past funds is provided for illustrative purposes and utilizes a different benchmark, as discussed below. Bloomberg, Barron’s, and Axios are not affiliated with Cache.</div>

<div class="blog_disclosures-text">Information current as of January 15th, 2025, Cache does not plan to update this material and is under no obligation to do so. </div>

{{black-diversify}}