Understanding Equity Compensation: An Employee's Guide

Editor’s Note: This article was contributed by EquityFTW – a blog we love for its ability to clearly explain the ins and outs of stock compensation. If you’re looking for ways to fully leverage your equity benefits while avoiding common pitfalls, EquityFTW should be a stop on your journey.

At EquityFTW, we spend a lot of time thinking about how different forms of equity compensation can have a bigger impact on people's lives. We enjoy writing about the equity employees receive because of the complexities and planning opportunities it creates.

However, there are many equity compensation types, varying policies within each company, and few reliable resources available online. That’s why it’s high time for an overview of the major plan types so you’re better equipped to make smart decisions with your own equity.

In this article, we’ll discuss the most common types of equity compensation, including:

- Restricted Stock Units (RSUs)

- Employee Stock Purchase Plans (ESPPs)

- Nonqualified Stock Options (NSOs)

- Incentive Stock Options (ISOs)

- Restricted Stock Awards (RSAs)

Companies offer stock-based compensation to incentivize, retain, and align the interests of the company and its employees. We feel these three goals are best accomplished when people understand more about their equity. This article is a great place to start, but we’ve also included links to more detailed guides below if you want to dive deeper into any of these plan types.

Restricted stock units (RSUs)

Restricted stock units (RSUs) are by far the most common form of equity compensation. Both public and private companies offer it and is a favorite because they are easier for employees to understand and easier for employers to administer than other types of equity at the company level.

Who can receive RSUs?

If a company is publicly traded, it’s almost guaranteed that people inside and outside of the company receive RSUs as part of their compensation. Employees can receive RSUs when first joining a company, upon promotion, and annually as part of a “refresher grant.”

Non-employees can also receive RSUs when they contract with the company to do company-specific work.

RSU vesting

The term “vesting” refers to the requirements you will need to meet in order for your RSUs to officially become yours.

If you’re at a public company, your RSUs will most likely just be subject to “time-based vesting.” This means that a portion of your RSUs will become yours as you’ve worked at the company for certain lengths of time. The most common vesting schedule releases one-quarter of your RSUs for every year you work at the company.

If, however, you work at a private company (i.e. a company that is not publicly traded yet), there’s a good chance you have what are called double-trigger RSUs. This type of RSU requires that you work for some designated period of time AND continue working until the company goes public or has some sort of liquidity event.

If you quit with RSUs before meeting the vest requirements, your RSUs are returned to your employer, and you don’t receive them.

5 benefits of RSUs

In our eyes, there are three primary benefits of receiving RSUs.

If you receive a grant of 100 RSUs, the company is saying to you that you’ll be eligible to receive 100 shares of company stock in the future if you meet all the requirements.

Other forms of equity compensation attach such things as multipliers, a percentage of profit, and other complexities, but with most RSUs, the deal is simply, “Hey, we grant you RSUs, and you’ll eventually get stock.”

1. One-for-one simplicity

If you receive a grant of 100 RSUs, the company is saying to you that you’ll be eligible to receive 100 shares of company stock in the future if you meet all the requirements.

Other forms of equity compensation attach such things as multipliers, a percentage of profit, and other complexities, but with most RSUs, the deal is simply, “Hey, we grant you RSUs, and you’ll eventually get stock.”

2. Value is easy to track

Since RSUs have a one-to-one value, it makes valuing them extremely easy.

If you have 100 RSUs and the company share price is currently $500, your RSUs are worth $50,000.

3. Offers upside in the company

With stocks, you purchase shares and then hope for the price to increase over time. With RSUs, it’s similar, only now you can begin hoping for an increase in price immediately after receiving a grant.

Even if your RSUs haven’t vested and they’re not officially yours yet, you still benefit from increases in price as you wait for your RSUs to vest.

4. Tax matters are simpler

It’s a little bit of a stretch to say RSU taxation is easy, but it’s much easier than all the other forms of equity.

RSUs are taxed at vest based on their value that day.

If your 100 RSUs vest today and your company is now trading for $550, you’d have $5,500 of taxable income to account for.

If you were to dedicate 10 minutes to studying RSU taxation it would likely provide you with more than enough information to cover the basics. We also created an RSU tax calculator to help you estimate taxes.

5. Retains some value even if price drops

Even though it’s not ideal for RSUs to be worth less in the present than when they were originally granted to you, they’ll still hold value (unless your company goes completely bankrupt).

This is an underrated benefit of RSUs.

Other forms of equity compensation may become completely worthless if the value goes down after your initial grant, but not RSUs.

If you see your grant of RSUs go from being worth $50,000 to $30,000, you can at least take solace in the fact that you’re still getting something of real value.

{{black-diversify}}

Employee stock purchase plans (ESPPs)

The next most common type of equity compensation is an Employee Stock Purchase Plan, which companies set up to help their employees purchase stock at a discounted price.

This may seem straightforward, but ESPPs can vary significantly. They can go from being an amazing benefit that’s a no-brainer to take advantage of to not be worth using at all. They also come with terminology that can take a little getting used to.

Why companies offer ESPPs

Companies like to offer ESPPs because they offer another way for employees and employers to get on the same page. When everyone has equity in the company, the thought is that everyone’s interests are aligned.

More than 40% of public companies offer some form of ESPP, and of the tech companies included in the S&P 500, it’s 85%, according to Aon. With ESPPs becoming more common as an employee benefit, whether a company offers them can be a deciding factor in potential new hires.

Note that there are two types of ESPPs: qualified plans and non-qualified plans, based on whether they meet the criteria in Internal Revenue Section 423. We’re only writing about qualified ESPPs in this article because they’re far more common.

Who can participate in an ESPP?

The IRS sets several rules for ESPPs, and one of the rules is that the ESPP can be offered only to employees – as opposed to other types of stock compensation, like RSUs, that allow non-employees to benefit.

Selling ESPP shares

You won’t owe taxes when you purchase ESPP shares, but you will someday when you sell.

There are two primary disposition types when it comes to selling your ESPP shares:

- ESPP Qualifying Disposition

- ESPP Disqualifying Disposition

A Qualifying Disposition is when you sell your ESPP shares at least two years from the beginning of your offering period and one year from your date of purchase. Anything shorter than that will be considered a form of disqualifying disposition. Here’s a graphic to illustrate.

Waiting the full length of time for a Qualifying Disposition can result in more gains being treated as long-term capital gains (which can equate to savings of anywhere from 8% - 17%).

We recently wrote an article addressing whether or not you should max out your ESPP, and it describes the traits of ESPPs that are worth maxing out and those that are not.

{{black-diversify}}

Employee stock option overview

The word “employee” before “stock options” is important because there are other types of options used to trade stock and those are not the type of options we’re talking about here. This section focuses on equity compensation types like Incentive Stock Options and Nonqualified Stock Options.

How employee stock options work generally

When a company grants an employee a stock option, it attaches a price to the option. From that time forward, no matter what the value of the company goes to, the employee can use that stock option to purchase a share of company stock at that originally agreed-upon price.

It’s like using a coupon. Only rather than getting a discount on Honeycrisp apples you’re able to get a discount on company stock.

There are two major forms of employee stock options – both share similar terminology, but they’re very different from each other.

Incentive stock options (ISOs)

ISOs are most commonly granted by new to new-ish start-ups. When start-ups first launch, one of the ways they’re able to get talent to help grow the business is by offering bigger chunks of equity.

ISOs are a great fit for smaller start-ups because (1) the IRS limitations on granting ISOs aren’t as relevant in the early stages of business, and (2) ISOs can provide significant tax savings if used properly.

The downside to ISOs is that managing them without an expert can be a major headache.

Exercising ISOs (plus AMT consequences)

When you exercise an ISO, you purchase a share of company stock directly from the company and officially become a shareholder.

Depending on what you have to pay to exercise your ISO and the value of the company per share on the day you exercise, that can create different tax implications.

The “bargain element” or “spread” at the time of exercise will either result in no taxes paid or it can trigger what’s called Alternative Minimum Tax (AMT).

AMT is a tax calculation that’s done every year whether you’ve realized it or not. When you go to pay taxes, you pay the higher of the AMT tax calculation or your regular tax calculation. Most of the time, you never see AMT pop up, but having a large bargain element on your ISO exercise is one of the things that can tip the scales. See the literal scales below for reference:

Crossing into paying AMT isn’t the end of the world. It can just lead to an unfortunate tax burden you weren’t expecting.

ISOs are often touted as a type of employee option that doesn’t create tax liability at exercise, but this is false. It doesn’t take much for you to cross into AMT territory, so it’s important to work with an advisor who can accurately project the tax implications.

ISO disposition types

Once you’ve exercised ISOs, there are two different disposition types (just like with ESPPs).

- Qualifying Disposition

- Disqualifying Disposition

The timeline is very similar to ESPPs, except now there’s no offering period.

A qualifying disposition is a sale of shares from ISOs two years after the grant date and one year from the exercise date. Here’s an image for reference:

If you wait for a Qualifying Disposition, any gain you have will be treated as a long-term capital gain (which has better rates than ordinary income).

If you have a Disqualifying Disposition within one year from exercise, you’re going to end up with ordinary income tax treatment (which isn’t as preferred).

Holding and your ability to sell ISOs

It’d be great if it were easy to exercise all of your ISOs, avoid AMT, and sell your ISOs for a profit every time, but the reality is that your ISOs may never be worth anything.

It’s not uncommon for employees to exercise ISOs and never see any value out of them. Some companies even restrict their employees' ability to sell shares after exercise in secondary markets.

That said, if you plan ahead and only exercise/invest what you feel comfortable losing, there’s a chance you can hit the jackpot and sell your shares for much more than you exercised them for.

If you have the ability to early exercise, exercising early and filing an 83(b) election can result in not needing to pay a lot upfront to exercise your ISOs, and you’ll likely avoid any AMT issues. EquityFTW covers all the basics of incentive stock options, including links and tools to help you understand if and when you should exercise your options.

{{black-diversify}}

Nonqualified stock options (NSOs)

NSOs are granted by all types of companies. They are granted by start-ups as well as some of the world’s largest companies. Since there are limits upon the number of ISOs that can be granted, NSOs are often granted to make up the difference so employees are compensated fairly.

Exercising NSOs and tax treatment

Unlike ISOs which may cause taxation at exercise, if there is a positive “bargain element” or “spread” on your NSOs, this will cause taxation at exercise.

Here’s a quick example. If you have NSOs currently valued at $10/share and have the ability to exercise at $5, you would owe taxes on the $5 difference at the time of exercise - even if your company is still private.

It’s annoying to have to pay taxes, but at least calculating the taxes is easier than it is with ISOs.

NSO disposition types

With NSOs, there is no special disposition type that you’re trying to shoot for. That said, the timing of short-term or long-term capital gains will still apply.

This means that after exercising, if you hold your shares for a year or longer, you’ll be eligible for long-term capital gains treatment on any gain from the exercise date forward.

Common strategy with NSOs

Since there’s no preferential tax treatment when exercising NSOs, it’s not uncommon for people to wait until they know they’ll be able to exercise and then quickly sell their shares.

By waiting until there’s certainty around the ability to sell shares, you also remove some of the risk of putting money into an exercise and then never getting any return on your investment.

If you have the ability to early exercise your NSOs, you can exercise and file an 83(b) election just like with ISOs. In fact, if you exercise and file an 83(b) election shortly after the grant when the FMV is the same as the strike price, you won’t owe ordinary income taxes at exercise!

We’ve written an in-depth article covering NSO tax treatment where we go over all these scenarios.

Restricted stock awards (RSAs)

The last common form of equity compensation that we’ll discuss is Restricted Stock Awards (RSAs).

RSAs are typically only granted to founders or very early employees at a start-up. The name may make you think they’d work exactly like RSUs, but there are a few key differences.

RSA vesting

Just like it is with RSUs, RSAs typically have some sort of time requirement for vesting. The vesting schedules can vary by the start-up, but even though it’s a different form of equity compensation, it’s still common to see a 4-year vesting schedule.

RSA purchase requirement

Unlike RSUs, RSAs typically have a purchase requirement for the shares to officially become yours. That cost is usually around $.0001 per share since RSAs are typically granted before the company is really worth anything.

Even with one million RSAs, at $.0001, you’d only need to pay $100.

RSAs and 83(b) Elections

Founders and early employees can make the most of their RSAs if they purchase shares after grant and immediately file an 83(b) election.

This 83(b) election will lock the tax event to the date of purchase, so even when the RSAs vest down the road, the founders or early employees won’t owe any taxes at vest.

RSAs and QSBS

The final and the biggest benefit to RSAs is their potential to be considered Qualified Small Business Stock (QSBS). The government has provided QSBS as an incentive to early investors to risk their capital on new businesses.

If the company qualifies for it and your equity meets certain requirements, you might be able to exclude up to $10M worth of capital gains when you eventually sell your position.

Typically if you’re receiving RSAs, the size of the company is small enough, it’s just a matter of checking to see if you and the company meet all of the other requirements.

If you’d like to understand more about how RSAs are different, we put together a detailed comparison of RSUs vs RSAs.

How to make equity compensation count

The landscape of equity compensation changes every day. Companies continue to try to find new ways to attract, motivate, and retain talent. In rough order, RSUs, ESPPs, ISOs, NSOs, and RSAs are the most common forms of equity compensation now, but it’s pretty easy to imagine a world in which a new plan type rises in popularity or new laws are written to reduce how beneficial another type of plan is.

Regardless of what changes might happen in the future, it’s important to be aware of the type of equity compensation you have and to put a solid plan in place to optimize it.

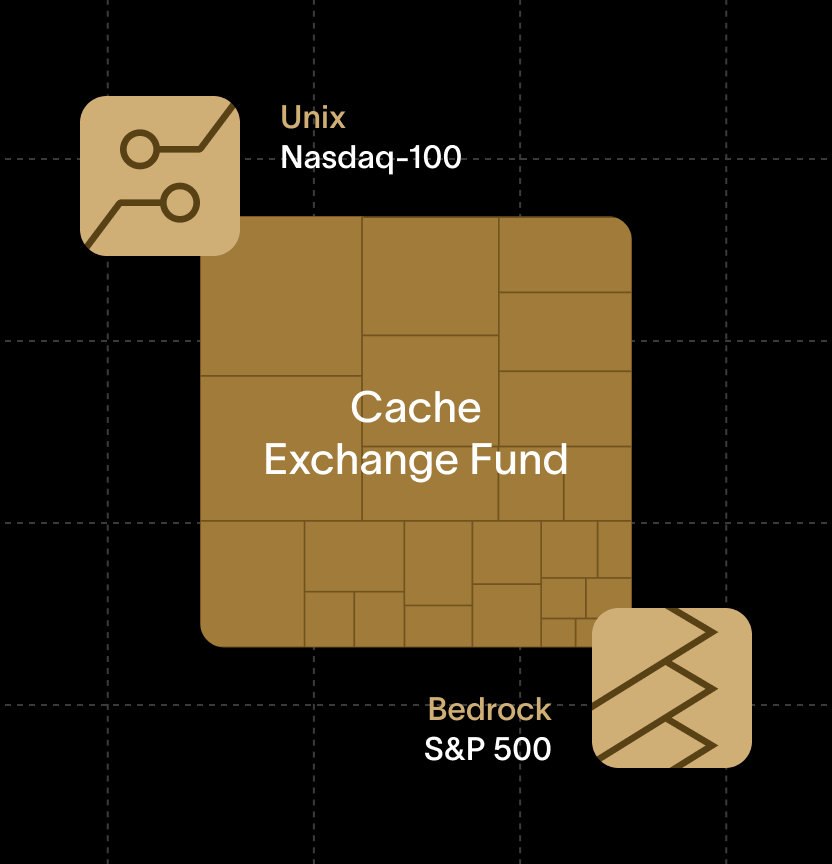

If you ever have any questions regarding your specific equity compensation package, EquityFTW’s detailed resources can help you make better decisions. And if your stock-based compensation causes your portfolio to have too much of one stock, you might want to consider products like the Cache Exchange Fund to help you make the most of your position.

<p class="blog_disclosures-text">Material presented in this article is gathered from sources that we believe to be reliable. We do not guarantee the accuracy of the information it contains. This article may not be a complete discussion of all material facts and is not intended as the primary basis for your investment decisions. All content is for general informational purposes only and does not take into account your individual circumstances, financial situation, or your specific needs, nor does it present a personalized recommendation to you. It is not intended to provide legal, accounting, tax or investment advice. Investing involves risk, including the loss of principal.</p>

{{black-diversify}}