Managing concentrated stocks? Understand the risk and strategies

We all know why you’re not supposed to put all your eggs in one basket; if something happened to the basket, all the eggs might break. In the investment world, “concentration risk” describes the potential for financial loss due to overexposure to a single investment, asset class or market segment in proportion to your overall portfolio.

For many investors, concentration risk is a good problem to have as it means that an investment has paid off handsomely. On the other hand, it can be stressful to watch your net worth ride the stock market roller coaster, and it can be hard to know when or how to get off.

This guide is designed to give you the tools you need to understand concentration risk, manage it, and stay true to your long-term investment goals.

What is portfolio concentration risk?

Most investment professionals say that concentration risk exists when more than 10% of your portfolio is tied up in one asset. When this situation arises, your exposure to that asset creates risk because you could potentially suffer significant financial losses if it performs poorly.

If you have a concentrated stock position, your portfolio experiences the movement of that stock in an outsized way. The timing of the stock’s upward and downward movements may (or may not) align with your specific investment and monetary needs.

For example, if you have "earmarked" the stock to pay for a large life expense (like buying a house, paying for kids’ college, or retiring comfortably), a rapid decline in price could disrupt your plans – even if the longer term performance is strong. In addition to your finances, the potential rollercoaster of holding a concentrated position might also affect your ability to sleep well.

As an example, Meta lost 64% of its value in 2022. Its value increased by 149% during the first nine months of 2023. Overall, the stock was down about 13% over that period. As an investor, you have to ask yourself if you are comfortable with the volatility of that investment experience.

Why is a concentrated position risky?

When you’re concentrated in a single stock, several potential risks to your portfolio can start to overlap:

- The risks of that particular business

- The risks of its industry

- The risks to its sector or geographic location

- Broad market risks and macroeconomic risks

Typically business risks pose the biggest threat, because most businesses are focused on doing one thing well. If a business runs into problems that impact its ability to do that one thing, its outlook can deteriorate quickly.

There are a few vulnerabilities that routinely sneak up on a seemingly-strong business. Here they are, along with some examples of some of companies that have been impacted:

The lesson? Bad things can happen to good businesses. If there’s an opportunity to take some risk off the table by diversifying some of your holdings, it’s often advisable to pursue it. We’ll take a closer look at some common options for diversifying from concentrated positions a little later in this guide.

How do investors get into concentrated positions?

More often than not, concentration risk is the result of one asset outperforming the rest of your portfolio. We meet a lot of investors who hold concentrated positions, and most of their experiences are similar to one of these three examples:

As you can see, all of these investors are on a good financial path – in large part because of the concentrated positions they hold. If you’re in a similar position, and your goal is long-term financial stability, it would be prudent to think about how diversification can help reduce your exposure.

{{black-diversify}}

How diversification can reduce risk

If you find yourself in a concentrated position, it’s probably the result of hard work, insight, and at least a little luck. The upward volatility of a single stock has served you well.

So, why diversify?

When holding a highly appreciated stock, a criticism of diversification can be that it lowers your potential for high returns. After all, if you could identify (or continue to hold) the next Microsoft or Apple or Tesla, wouldn’t it make sense for you to keep all your eggs into that one basket?

No matter how confident you might feel, there’s no way to find out whether a stock will go up until time passess. The stock you think is “the next Microsoft” may well turn out to be the next MicroStrategy instead.

(If you’ve never heard of MicroStrategy, then we’ve made our point. MicroStrategy went from $3,130 per share in March 2000 to $15.10 by the end of 2002 – a loss of 99.5%.)

There’s a common saying, however: “concentration builds wealth, diversification preserves it.” Keeping your money spread across many stocks, industries, and asset types is a kind of insurance against the risk of being wrong. However diversification doesn’t just minimize your odds of being wrong. It also maximizes your chances of being right.

Over long periods of time, only a handful of stocks turn into juggernauts that go up exponentially. When you own a diversified portfolio, there’s a greater chance that some of those high-performing stocks are part of it.

Of course, all investments have risk and a diversified portfolio can also lose principal. Back in 2022, for example, the entire Nasdaq index was down around 35% from its November 2021 peak. However, drawdowns from previous highs were up to 95% for some individual stocks in the index. Spreading your investments among the mix of winners and losers (using an investment vehicle like a broad index fund) reduces the risk of a loss while unlocking potential upside.

There’s even statistical evidence that a diversified position tends to outperform a concentrated position over time. A 2022 study of almost 100 years of US stock market data found that stocks which were among the top 20% of performers for any five year period went on to lag the market 86% of the time over the next 10 years. That number has climbed to 93% since World War II. Given this performance, the study’s authors came to a pretty firm conclusion: “The case for diversifying concentrated positions in individual stocks, particularly in recent market winners, is even stronger than most investors realize.’

While past performance offers no guarantee of future returns, reducing your concentration risk by diversifying your holdings could be a better way to reach your long-term objectives. Keep in mind that diversification does not guarantee investment returns and does not eliminate risk.

Barriers to diversification

Even if diversification is aligned with your objectives, a number of practical and emotional considerations might keep you from actually doing it. From potential tax consequences to fear of missing out on hypergrowth, there can be a lot of potential hangups. You may also have a hidden bias that’s keeping you from adopting a more prudent investment strategy.

We talk to a lot of investors who are dealing with concentration risk, and these are the biggest obstacles they face:

Tax tradeoffs

Concerns about taxes are the most common reason for inaction. If you’re in a high tax bracket, your long-term capital gains taxes can range from 23.8% to 38% depending on where you live. Even if you reinvested the proceeds from a sale thoughtfully, it would take years for your portfolio to return to its previous level.

Loss aversion is a well-understood concept in behavioral economics. Investors often prefer uncertain future gains over certain losses. Understandably, many choose the risk of a concentrated position over this tax hit on their highly appreciated stocks.

Loyalty to your company

It is hard to diversify when you’ve spent years working at a company and cheering for its success. We know, because we’ve been there. Loyalty to a company you helped build (and to the stock that helped build your portfolio) are valid feelings. But is the stock you earned as equity compensation likely to outperform a diversified portfolio on a risk-adjusted basis? Very few stocks do, and it is often only apparent in hindsight.

In fact, the 100-year study we cited earlier also found that: “The odds are rather stacked against a concentrated position in a recently top-performing stock beating the equity market as a whole over the next ten years, yet this is a common situation faced by investors who hold concentrated positions.”

Keep in mind that there’s a second potential risk if you still work at that company. If both your income and your net worth are derived from the same source, you could experience a lot of pain if your company runs into a rough patch.

Anchoring bias

When you see a specific price associated with any type of good, your mind tends to latch onto that number when you make decisions. For example, seeing an item in a store that’s marked down from $1000 to $100 may make it seem like a good deal – even if the original price was artificially high. Your brain’s subconscious use of irrelevant or outdated information is called anchoring.

So what happens when your concentrated stock drops a little below its record high? You might feel like you’re “losing” money when you sell the stock for a lower price. The mental benchmark you’ve set might keep you from considering diversification until the price goes back up, even if you’re still in a highly appreciated position. The unfortunate truth of the matter is that a majority of these stocks have historically never returned to their all-time-highs - it is often a permanent loss, and investors would be better served acknowledging it, rather than relying on hope.

Fear of Missing Out (FOMO)

Working hand in hand with anchoring bias, the fear of missing out on future returns can also keep you from pursuing a more prudent investment strategy. Building your concentrated position has probably been rewarding in lots of ways. Who wouldn’t want the ride to continue indefinitely? And who would want to give up on the potential for more upward volatility? It’s natural that FOMO will get you to second-guess your decision to diversify.

If you feel torn about taking steps to reduce concentration risk, we recommend talking to a financial advisor to get an informed opinion that takes your circumstances into account. If you’ve accumulated a lot of wealth relatively rapidly, it can be good to get a sophisticated outside perspective. As you’ll see in the next section, some of the tax-advantaged methods for diversifying your holdings might also require help (or at least explanation) from a pro.

Tools for managing concentration risk

When you’re ready to diversify away from a concentrated position, you’ll have three objectives you need to balance:

- Reducing your concentrated holding below 10% of your portfolio

- Replacing your concentrated stock with assets that spread your exposure more widely

- Limiting the tax burden you’ll take on

Should you just sell and diversify?

The most common and simplest strategy is the “sell-and-diversify” approach. You just sell your stock, pay your taxes, and buy assets that diversify your holdings – typically index-based mutual funds or ETFs that track broad segments of the stock market.

That’s basically the whole strategy.

If you adopt it, you would generally want to hold your concentrated stock for at least one year to qualify for long-term capital gains taxes. You may also want to dollar-cost average out of your concentrated position by slowly diversifying your concentrated stock at regular intervals (instead of selling it all at once).

At the end of the day, though, this strategy is popular because it spreads your risk and it’s simple. However, it does very little to reduce the tax liability that can consume up to 38% of your principal.

Common tax-advantaged alternatives

As you start to consider tax implications, you should know that there are several investment strategies that let you avoid or defer the “sale” that triggers taxes. Many of these tools are only available to certain investors, but they may be worth exploring with your tax or financial advisors:

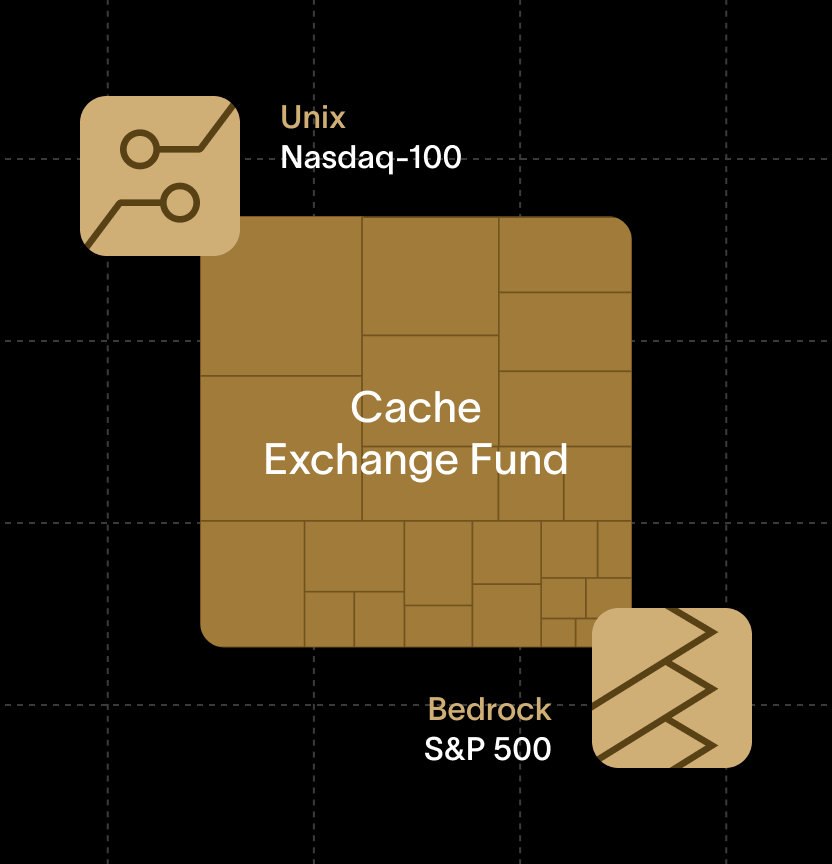

Exchange funds

These funds let you pool your concentrated stock with stocks from other investors to create a diversified fund. Often exchange funds are designed to approximate the performance of a market index. You participate in index funds by swapping your stock for a pro-rata ownership share of the fund. After a seven-year holding period, you can withdraw a diversified basket of stocks, and you don’t have to pay taxes until you decide to sell them.

Exchange funds require a long-term commitment, however they reduce your concentration risk and let you defer taxes. Try our exchange fund calculator to get a better idea of how they might impact your portfolio. Or see how they work in more detail.

- Best for: Highly appreciated positions that are tough to diversify without a significant tax bill.

- Restrictions: $100K minimum investment

- Term: Long-term

Some risks involved with exchange funds include limited liquidity, investment constraints, the tax laws could change, and although diversification reduces the concentration risk, it does not eliminate investment risk completely. It is still possible to lose principal when you participate in an exchange fund. Restrictions vary by exchange find provider.

{{black-diversify}}

Qualified small business stock exemption (QSBS)

If you’re founder, investor, or early employee in a startup, you may qualify for a QSBS tax exclusion — potentially covering 100% of your capital gains tax liabilities. Your company must meet a number of thresholds to be eligible, but QSBS can be a great reward for the people who take on the risk of building something big.

- Best for: Highly appreciated positions in qualifying investments.

- Restrictions: $10M limit to the tax exemption

- Term: Long-term.

Charitable giving vehicles

There are two common methods for making charitable contributions that can offset tax liability, allow for diversification, and potentially provide income: Donor Advised Funds (DAF) and Charitable Remainder Trusts (CRT). In both cases, the concentrated stock you contribute is ultimately donated to a charity, but you get to unlock the value of appreciated assets during your lifetime. If this is of interest, you should work with a tax expert to understand the nuances and decide which vehicle is right for you.

- Best for: When you’d like some or all of your contributions earmarked for charity. Receive a tax deduction to optimize your current tax liabilities.

- Restrictions: Fees may be prohibitive for smaller investments.

- Term: Long-term or Life

Estate planning

Upon your death, the cost-basis of your concentrated stock steps up when it is passed to your heirs. That means they won’t face any capital gains taxes (although they could be responsible for estate taxes). This approach doesn’t remove your concentration risk and it doesn’t benefit you in your lifetime, however it does address the issue of tax drag for most investors. Other vehicles, like exchange funds, remove this concentration risk and can give you similar tax benefits.

SMAs with tax-loss harvesting

“Separately Managed Accounts” are a more advanced version of the “sell-and-diversify” method. Instead of investing in index funds, SMAs rely on “direct indexing” which means buying all the stocks in an index fund. These actively-managed funds can use tax-loss harvesting to capture capital losses as the individual stocks they hold move up and down. Over time, those harvested losses can offset some of the capital gains in your concentrated position. Fees are higher than buying index funds and there can be large minimum investments, but you should be able to diversify and reduce some of your tax liability.

- Best for: Moderate appreciation in held stocks, plus significant cash to invest.

- Restrictions: Fees may be prohibitive for smaller investments.

- Term: Long-term

With varying fees and high minimum account requirements, SMA’s are not right for every investor. We wrote a detailed comparison of direct indexing versus exchange funds to give you a general sense of the advantages and disadvantages.

You can also take consider other sophisticated investment vehicles like collar advances or you can hedge your concentrated position by buying options that reduce some of the risks in your portfolio.

This list is not exhaustive, so you may want to talk to an investment advisor to see which one is the best fit – or if there are other alternative approaches that might help you meet your goals. There can be additional tax considerations with RSUs and other forms of stock compensation, so a professional opinion can be helpful.

Next steps for your portfolio

If one stock makes up a big part of your portfolio, understanding the risks and investigating your options is the right thing to be doing. Keep in mind that there’s very little risk in getting an unbiased opinion from a financial advisor if you have lingering questions. By managing your concentration risk now, you may be taking a big step toward ensuring a brighter future.

Our company, Cache, offers modern exchange funds that may be able to help you diversify your portfolio, defer your taxes, and meet your investment goals. We also have lower minimum investments and lower fees than traditional providers. If you have any questions about what we do, we’d love to hear from you. Tell us about your situation, and we’d be happy to talk through how exchange funds work, or take a look at our calculator to see how an exchange fund compares to the sell-and-diversify approach.

<p class="blog_disclosures-text">Material presented in this article is gathered from sources that we believe to be reliable. We do not guarantee the accuracy of the information it contains. This article may not be a complete discussion of all material facts, and it is not intended to be the primary basis for your investment decisions. All content is for general informational purposes only and does not take into account your individual circumstances, your financial situation, or your specific needs, nor does it present a personalized recommendation to you. It is not intended to provide legal, accounting, tax or investment advice. Where specific advice is necessary, we recommend you consult with a qualified tax professional before investing. Investing involves risk, including the loss of principal.</p>

{{black-diversify}}