Diversify your stocks. Defer your taxes.

Exchange your stock for an S&P 500 or Nasdaq-100 benchmark without triggering taxes. A time-tested strategy used by the ultra-wealthy, now available for you.

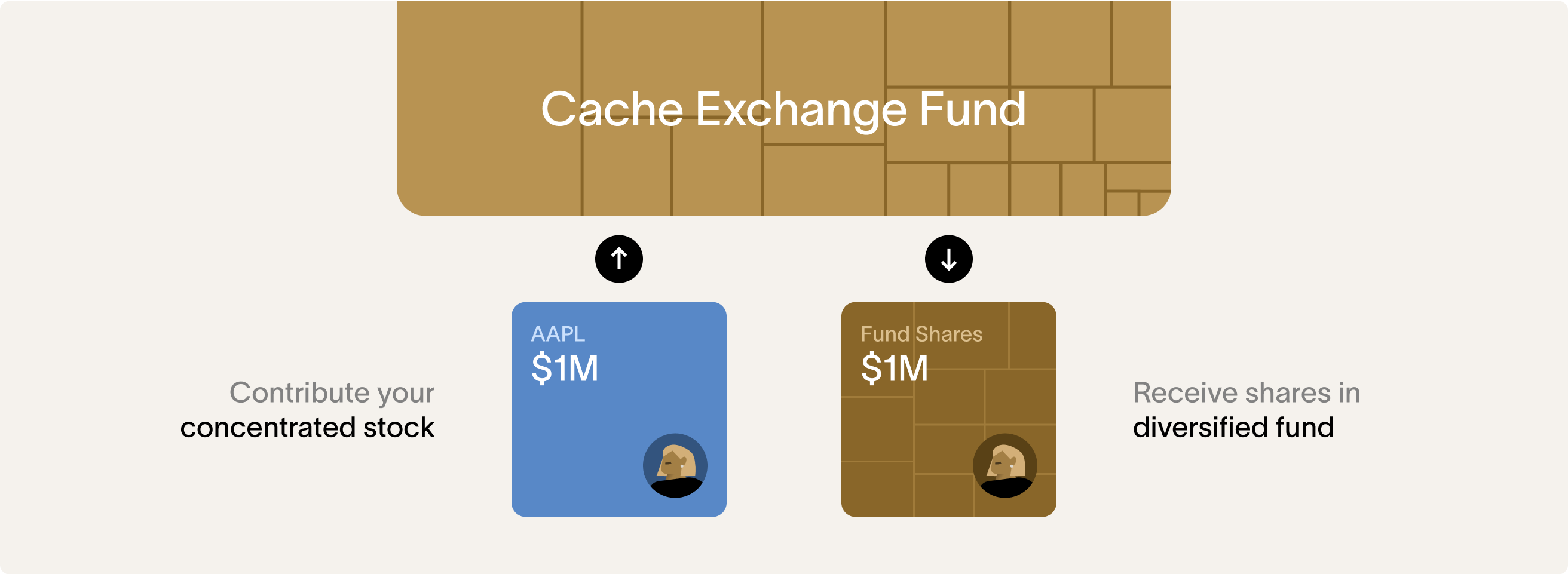

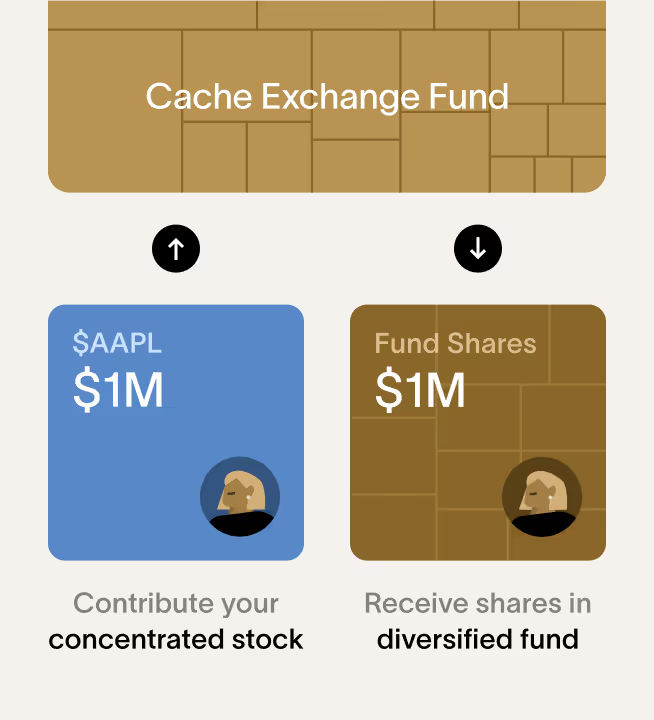

A fund you buy with your stock

Turn appreciated shares into a diversified portfolio—without selling your stock.

Put 100% of your capital to work

Contributions to an exchange fund aren’t taxable under IRC 721. Your full pre-tax value stays invested and compounding.

Diversify instantly, not over years

Tax-loss harvesting strategies can be slow or impose excessive leverage and risk. An exchange fund diversifies you on day one.

Get a broad portfolio and defer taxes

After seven years, you can exchange your fund shares for a mix of ETFs and stocks, while continuing to defer your taxes.

It's the smarter way to diversify

“Doing it in a tax-efficient way almost feels like you’re already ahead”- David Zhang (Client), former lead at Tesla

Trustworthy by design

Owned by fund investors, not Cache

Each exchange fund is owned by its investors, with Cache serving only as an advisor.

Funds held at BNY Mellon

Each fund custodies assets at BNY Mellon, the world’s largest custody bank with $50T+ in assets.

Independent admin and audit

Independent administration, accounting and annual audits ensure checks and balances.

Registered and regulated

Registered as both a broker-dealer and investment advisor with the SEC and FINRA.

Leaders across tech and finance

have chosen Cache

- Eli Lilly

- Google

- Apple

- Microsoft

- Adobe

- Eli Lilly

- Google

- Apple

- Microsoft

- Adobe

- Eli Lilly

- Google

- Apple

- Microsoft

- Adobe

- J.P. Morgan

- Meta

- Nvidia

- Amazon

- Amgen

- J.P. Morgan

- Meta

- Nvidia

- Amazon

- Amgen

- J.P. Morgan

- Meta

- Nvidia

- Amazon

- Amgen

Job title and company listed is provided for illustrative purposes only to show examples of the types of investors who have invested in the fund.

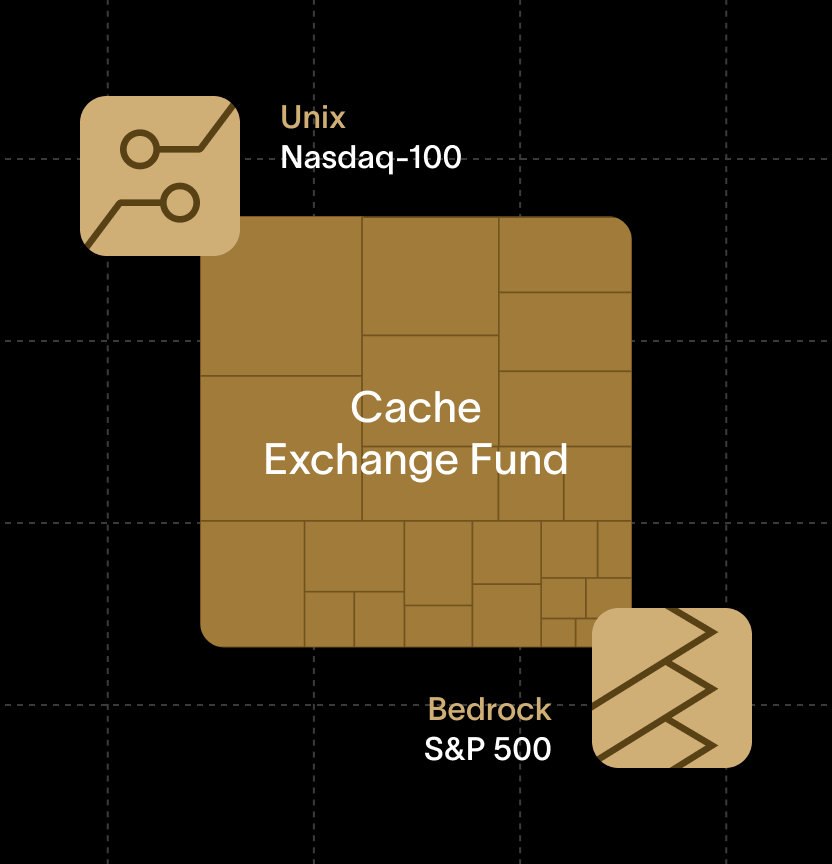

Funds built for your wealth journey

Flagship Fund Series

Our flagship funds built for Qualified Purchasers.

Tap into the engine of innovation with a technology-heavy portfolio.

Access the foundational broad market exposure across the U.S. economy.

Gain exposure to the fastest growing companies across all sectors.

Access Fund Series

Our democratizing funds built for Accredited Investors.

Tap into the engine of innovation with a technology-heavy portfolio.

A better exchange fund

Re-engineered for precision

Engineered to stay closer to the benchmark. Our Index Sync technology enables us with ETF rebalances to deliver predictable returns without the gaps of traditional exchange funds.

Institutional-Grade Real Estate

A thoughtful strategy to access widely diversified, high-quality real-estate portfolios with experienced managers, not individual buildings bought right before the close.

More choice at lower fees

From growth to broad market, Cache offers more fund choices for you. Your investments are aggregated across funds, lowering your effective fees. Additional discounts are available.

We’re breaking down barriers for you

Cache

Other exchange funds

Lower fees

0.40% - 0.95%

0.25% after

seven years

No sales fee.

Stock discounts.

Wholesale discounts

through your advisor.

Lower fees

More than 70% higher

Sales fee:

up to 1.5%

Annual fee:

0.85% - 0.95%

No tiered pricing.

No stock discounts.

Lower minimums

$100K

Lower minimums

$500K - $1M

Onboarding frequency

Every two weeks

Onboarding frequency

Quarterly or semi-annually

Broader eligibility

Unlike traditional exchange funds, we serve both accredited investors and qualified purchasers.

Higher capacity

Our unique Index Sync structure allows for higher capacity through ETF rebalancing.

A modern experience

A digitized experience for clients and their advisors, with white-glove support along the way.

All you need to know

A complete

diversification toolkit

Access all the tools you need to diversify your concentrated stocks in one place.

Cost basis of your shares

For shares with significant embedded gains

For managing transitions from shares with moderate gains

For diversifying shares with low embedded gains

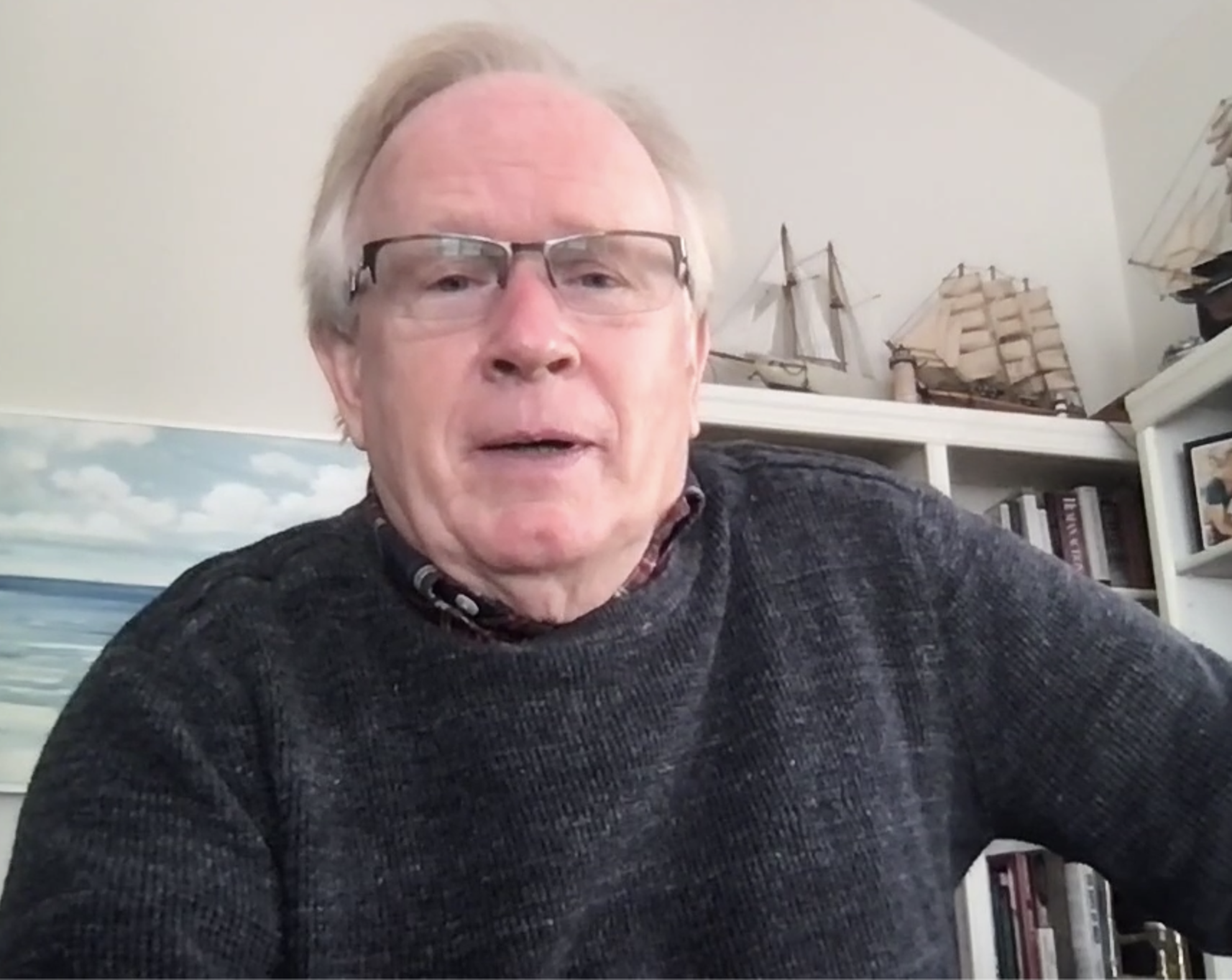

Hear what our clients say

Cache does not pay for testimonials or endorsements

Common questions

The Basics

(X)

What's the main benefit of participating in a Cache Exchange Fund?

What are the investment goals of the Cache Exchange Fund?

Is there a taxable event after seven years? What will I receive, and what are the redemption fees?

What do you mean when you say your fund “approximates the index”?

What happens when the stock I contribute to the fund goes up or down?

How are dividends and other income treated?

What tax considerations may come up while I’m in the fund? Is there an annual K-1?

Who can participate in the Cache Exchange Fund – and which stocks are accepted?

Eligibility

(X)

How is an Exchange Fund different from an ETF?

What if I don’t meet the minimum investment amount?

May I contribute stock for a company I work at? Can I contribute unvested equity?

What happens to my cost basis over the course of the fund?

How does the real estate investment work? What happens to it after seven years?

Do you rebalance the fund quarterly, like the actual Nasdaq 100?

How are investors protected if Cache is no longer viable?

Benefits

(X)

Is the Cache Exchange Fund designed to improve my returns?

How does a Cache Exchange Fund compare to products from other providers?

How does the Exchange Fund help me avoid tax drag?

How does the Exchange Fund reduce my concentration risk?

How does Cache determine and charge fees?

How does the seven-year holding requirement compare to other providers?

Do you offer multiple funds, or is it one fund with different enrollment windows?

Getting Started

(X)

How does the reservation and formation process work?

How do you determine who gets an allocation and how big each fund is?

What happens when the fund closes?

Why do you institute a two-year lockup?

How do redemptions work before the seven-year mark? Are there any fees?

How do redemptions work once the fund “matures” after seven years? Are there any fees?

Can I transfer my shares in the fund shares or borrow against them? What are the details?

Let AI do the research

Ask AI if a Cache Exchange Fund is right for you.

.png)