From Tesla Rollercoaster to Portfolio Balance: How Cache Transformed One Investor's Wealth Strategy

After years at a high-growth tech company, David Zhang, a Tesla executive, found himself with a concentrated Tesla position and a growing sense of financial vulnerability. He knew diversification was necessary, but the path to get there wasn’t clear. When he discovered exchange funds, he thought he had found the solution, as they would enable him to diversify without incurring an immediate tax bill, keeping his investment working for him. However, when he approached traditional funds, he wasn’t able to gain access to them, due to the fact that there was no current availability for Tesla stock.

Testimonials are provided by a current Cache investor and may not be representative of the experience of other customers. A conflict of interest exists in that the client is an investor in a Cache investment. The testimonial is no guarantee of future performance or success. The individual was not compensated for this testimonial and this is not a paid testimonial.

The Solution: Cache’s Direct, Transparent Approach

David described the unease that he and many tech execs feel, saying, “The large amount of your personal wealth tied up in one or two positions is always this up-and-down rollercoaster feel.”

He knew he needed to diversify. But accessing a traditional exchange fund came with layers of friction. He wasn’t pleased with the legacy funds he researched. Then he found Cache.

With Cache, David bypassed the gatekeeping and confusion that had stalled his diversification strategy for years.

“Cache was much more direct, straightforward, very clear how it all worked together, and very upfront with fees,” explained David.

With frequent closing dates, a clear dashboard, and the ability to engage without an intermediary, Cache provided him with the tools to move forward on his own terms, offering the transparency he was seeking.

The Results: Confidence Through Tax-Efficient Diversification

Using Cache, David implemented a disciplined, long-term approach to diversification, without trying to time the market.

“Doing it in a tax-efficient way almost feels like you're already 30% ahead.” He was able to keep what he would have had to pay in taxes in the market, which continues to grow.

Addressing a Common Investment Challenge

Many accredited investors face this common challenge: excessive wealth tied up in a single stock, combined with limited access to institutional diversification strategies.

David found that because of the low accessibility of traditional exchange funds, many investors don’t even know they are an option. “Awareness is relatively low,” he explained.

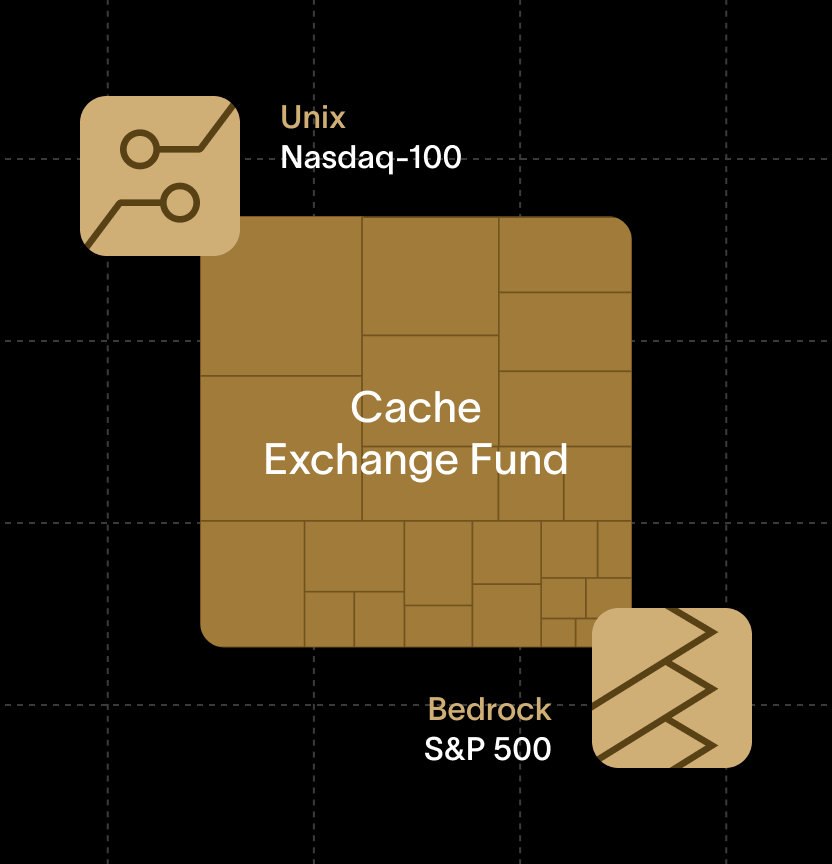

Cache is democratizing a proven wealth preservation tool. We make it accessible, transparent,

and built for modern investors.

See How Much You Could Save

Curious how tax-efficient diversification could impact your portfolio?

Use our calculator to estimate potential tax savings when contributing your stock to the Cache Exchange Fund.

Ready to Take the Next Step?

If you’re sitting on a concentrated stock position, you don’t have to ride the rollercoaster. Cache gives you the tools to diversify on your terms—with institutional-grade access and real tax advantages.

See if your stock qualifies

It takes 60 seconds to check eligibility for the next fund close.

If you’d like to see how Cache can help your firm build stronger connections with clients, set up a time to talk or enter some basic information to see if an allocation is available.