Announcing our ‘Flagship Series’ Exchange Funds for Qualified Purchasers

Just six months ago, Cache launched its first exchange fund. Our mission was to make it easier to manage large stock positions and break down the barriers to accessing sophisticated investment products.

Our first fund did so by expanding eligibility, reducing minimums, and simplifying the complex enrollment process — all with lower fees than traditional exchange funds. These innovations caught the attention of major publications like Bloomberg, WealthManagement, and Barron’s, and drew thousands of investors who enrolled for a spot in our funds.

In response to the overwhelming interest — and to address feedback we’ve received — we’ve now expanded our offering into two distinct product lines, each tailored to different types of investors.

Cache 'Access' Funds: Designed for accredited investors like mid-career corporate employees, offering exchange funds and tax-deferred diversification to an audience that previously lacked access.

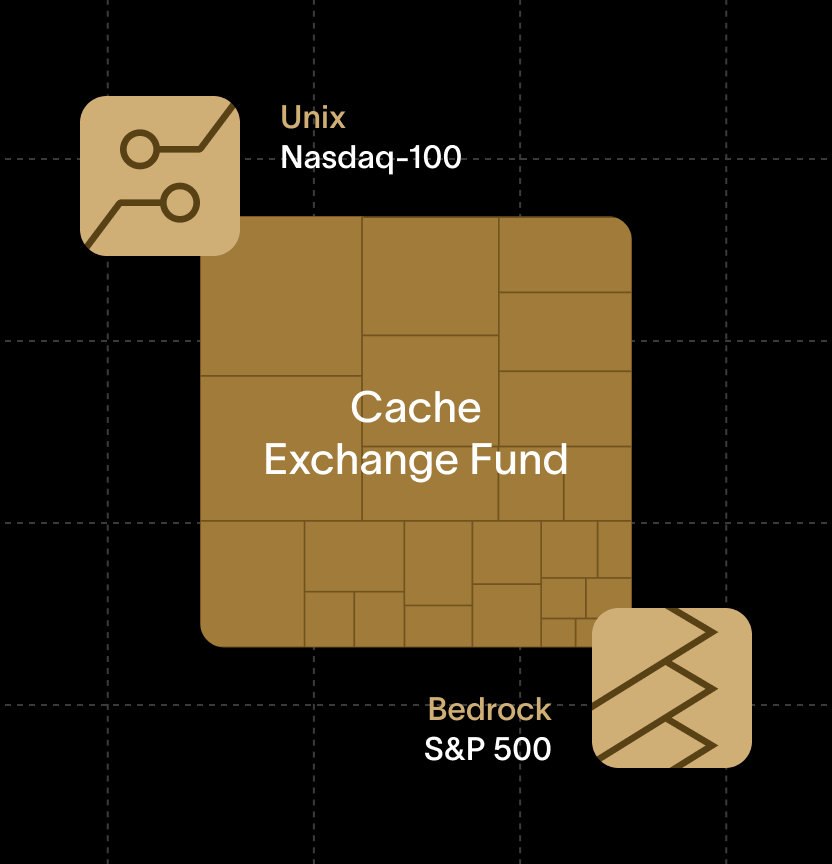

Cache 'Flagship' Funds: Built for qualified purchasers, including corporate executives, private wealth clients, family offices, and other high-net-worth individuals. These funds accommodate larger contributions and provide more flexibility in diversifying concentrated positions.

Here’s a quick comparison between our two fund types:

Here’s what stays consistent across all our funds:

Faster diversification: We typically offer monthly fund closes, allowing you to diversify within weeks of committing to invest, not months or years. With dedicated funds for both qualified purchasers and accredited investors, we can add new positions more quickly.

Greater capacity: By offering two fund types, we can better align investments to meet different needs. Our Flagship Funds see average investments that are more than double those of our Access Funds, allowing for a better match with each investor’s goals.

Lower fees: With these funds, we remain committed to offering a high-quality product at a fair price, while constantly seeking to elevate the quality of service you experience.

We held our first closing on the first Flagship fund on Aug 30th, and it marked our largest close yet. Curious if you’d be a match for the next close of the Cache Exchange Fund? Check availability for your stock position here.

<div class="blog_disclosures-text">Individuals can qualify as an Accredited Investor if they have an annual income exceeding $200,000 (or $300,000 jointly with a spouse) for the past two years and expect the same for the current year. Alternatively, individuals can qualify by having a net worth over $1 million, either individually or jointly with a spouse, excluding the value of their primary residence.</div>

<div class="blog_disclosures-text">Qualified Purchaser status requires individuals to meet specific financial thresholds. An individual becomes a Qualified Purchaser when they own at least $5 million in investments. Companies or investment managers also qualify if they have investments valued at $25 million or more.</div>

<div class="blog_disclosures-text">Monthly Closes are a goal of Cache however there is no guarantee this will occur and can be modified at Cache’s discretion. Minimum contribution amounts are noted in the fund offering documents and can be modified or waived at the discretion of Cache</div>

<div class="blog_disclosures-text">For the minimum holding period of both the Access and Flagship fund series, please refer to the redemptions section of the offering documents. Additionally, some restrictions could supersede the minimum holding period at the discretion of the manager and prevent withdrawals such as market volatility. Before redemption, the investor needs to satisfy the notification requirement in the offering document. Early withdrawal penalties referred to as redemption fees are payable based on a percentage of the fund’s net asset value and payable to Cache Securities. Investors' redemptions will typically be for the lesser of the then net asset value of the Shareholder’s Shares on the fund or the value measured on the date of redemption of the securities then held by the fund. Fees are provided as a representative example but are not guaranteed and can be modified by Cache subject to the terms specified in the offering documents.</div>

<div class="blog_disclosures-text">All investments involve risk. Before making an investment decision, investors should carefully consider the risks associated with the investment and determine, based on their own circumstances, whether it aligns with their investment objectives and risk tolerance. While diversification may help spread risk, it doesn't guarantee profit or protect against loss. Investing in securities could result in the loss of your entire principal.</div>

<div class="blog_disclosures-text">Securities are distributed by Cache Securities LLC, Member FINRA/SIPC. Cache Advisors LLC is the advisor to the Cache Exchange Fund and is an Investment Advisor registered with the SEC. Registration with the SEC does not imply a certain level of skill or training. Cache Securities and Cache Advisors are affiliated and under common control of Cache Financials Inc.</div>