Joel Meek isn’t one to leave his financial future to chance. He was fortunate to have large, concentrated stock positions from his time in tech as a Finance and Operations Executive at Reddit, Pinterest, and Google Cloud. But he knew there was danger inherent in having such a large portion of his assets tied up in just a few stocks. He also knew diversifying could alleviate some of that risk, but he wasn’t eager to face the massive tax bill that would come his way if he sold his stock to diversify.

He did his financial research and spoke to his financial advisor. He knew that an exchange fund made sense, that it would allow him to diversify without triggering immediate taxes.

The problem? He couldn’t get into one.

“I worked with wealth managers at both of those firms for years and was repeatedly told there was no access. And it was quite frustrating because I knew it was a product I wanted to use.”

Testimonials are provided by a current Cache investor and may not be representative of the experience of other customers. A conflict of interest exists in that the client is an investor in a Cache investment. The testimonial is no guarantee of future performance or success. The individual was not compensated for this testimonial and this is not a paid testimonial.

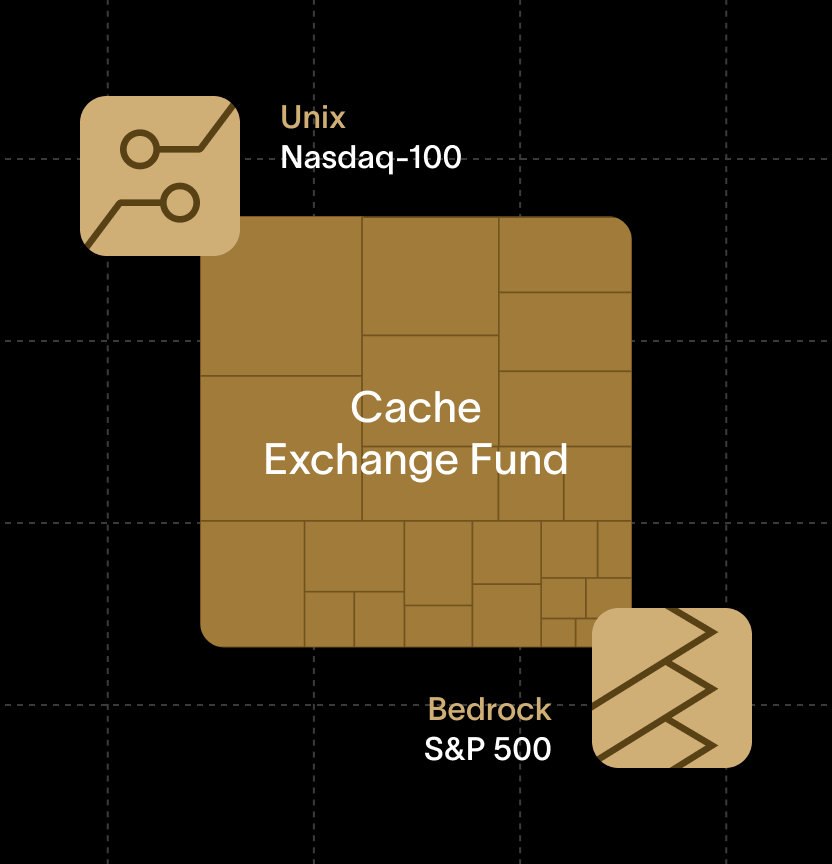

That’s where Cache Exchange Funds came in. Cache stood out not because it gave him direct access to diversify, but because the model made sense for his long-term goals.

Meeting Long-Term Goals without Short-Term Pain

“An exchange fund was just one thing I did out of multiple things when I was diversifying… but it was the one I was most excited about. I was able to defer taxes and also get diversification. I felt like it was the best option for building my long-term wealth.”

Another big difference Meek found between Cache and legacy funds was the ease in which he was able to onboard and manage his investment. The entire experience, from education to enrollment was modern, simple, quick and transparent.

“I was pleasantly surprised when I discovered Cache. I was able to talk directly with the company. The process was super simple. I’m a happy customer.”

“It was much more transparent, much more direct, much quicker than working with some of the legacy exchange funds.”

Above all, he was confident that his assets were in a fund benchmarked for growth against the Nasdaq-100.

“They're indexing, or they're trying to track to the NASDAQ, and actually, as someone who's worked in tech that is an index I like.”

Just as important? The people behind the product.

“I like that it was founded by other technology employees. I felt like they got it—they understood the challenge I was facing and provided a solution that actually solved it. I wasn’t expecting that. That’s been great.”

Investing with Family In Mind

With Cache, Joel was able to make progress on his diversification strategy without compromising his tax position or rushing into decisions.

“By using Cache, it made me feel like I was making smart decisions that were good for the long-term wealth for me and my family.”

And Joel’s experience isn’t unique. On average, investors defer over $700,000 in capital gains when they diversify through Cache Exchange Funds—keeping more of their portfolio working, and less going to taxes.

“I can see it being an option that almost everyone should consider if there’s a portion of their assets they don’t need to use immediately.”

If you’d like to see how Cache can help your firm build stronger connections with clients, set up a time to talk or enter some basic information to see if an allocation is available.