Borrow against your concentrated stocks. No margin calls.

Access up to 90% of your stock’s value to buy a home or fund investments. Lock in a lower fixed rate, defer your taxes, and eliminate liquidation risk.

Cache does not pay for testimonials or endorsements

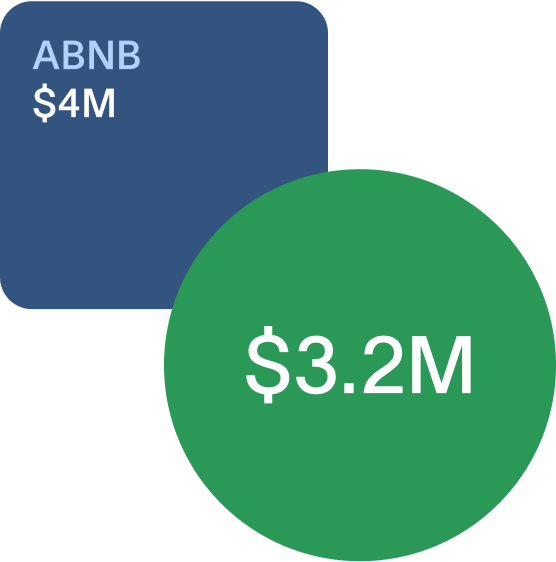

How a $4M position turns into $3.2M in cash.

Lets say you hold $4M in a single stock (though our minimums start at ~$1M). You want to bridge to a new opportunity today. A Collar Advance turns that position into liquidity without a huge tax bill.

How? We place a synthetic "collar" on your stock (a floor and a cap), ensuring the value never falls below the floor. This defined risk profile allows the bank to lend a higher amount against your asset safely.

Because the bank’s risk is contained, you can lock in a fixed rate for the term. The rates can be as low as 3.7%, which is significantly lower than traditional margin loans, and comes without the risk of margin calls.

Instead of paying taxes today, you defer them until the contract matures. At the end of the term, you can settle the advance using your stock or cash, effectively bridging you to a future liquidity event.

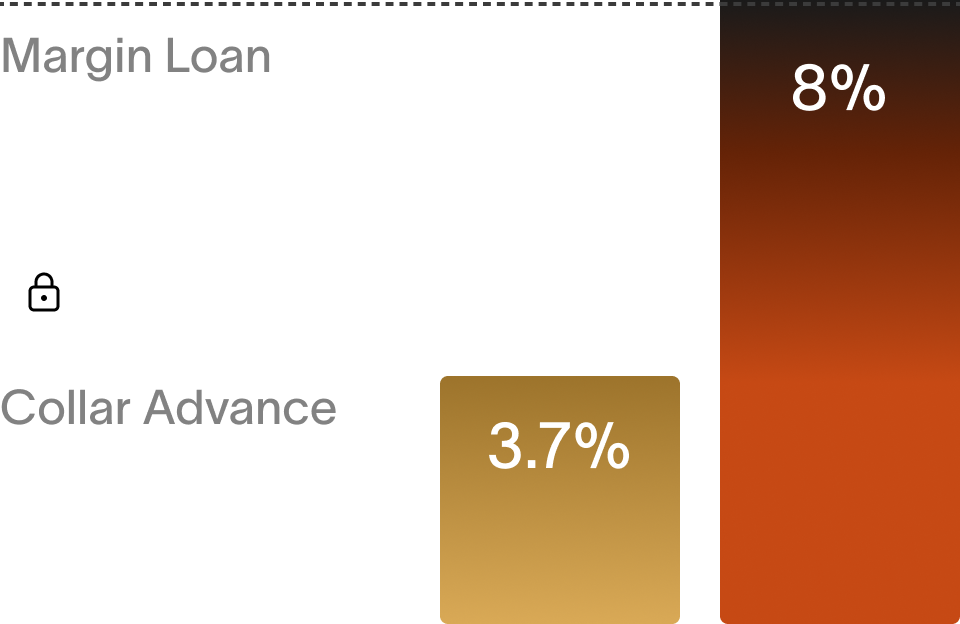

Borrow at rates lower than the alternatives

Rates Disclosure – Information is current as of 12/10/25

Rates shown are illustrative, may not be available to all clients, and depend on collateral quality, loan term, issuer concentration, and market conditions. Examples were sourced from select industry participants, do not represent a comprehensive survey of the market, and will not be updated.

Stock-based lines of credit and margin loans are generally liquid, while collar advances are illiquid and typically have terms of two to five years. A collar advance involves derivative contracts that limit both downside risk and upside participation. Investors may forgo gains above the cap and may be required to deliver shares or cash at maturity depending on market performance. Margin loans and stock-based lines of credit do not limit upside participation; however, rates are variable and positions are subject to margin calls.

Your rate is locked for the entire term. Unlike margin loans that float with market rates, your cost never increases—even if the Fed hikes

rates.

There are no monthly bills to pay. Interest is capitalized at the beginning of term, and you receive a lump-sum payment post interest and execution expenses.

This structure was only available for clients with tens of millions in a single stock. We’ve brought the entry point down to ~$1M, giving you the same tools used by the ultra-wealthy.

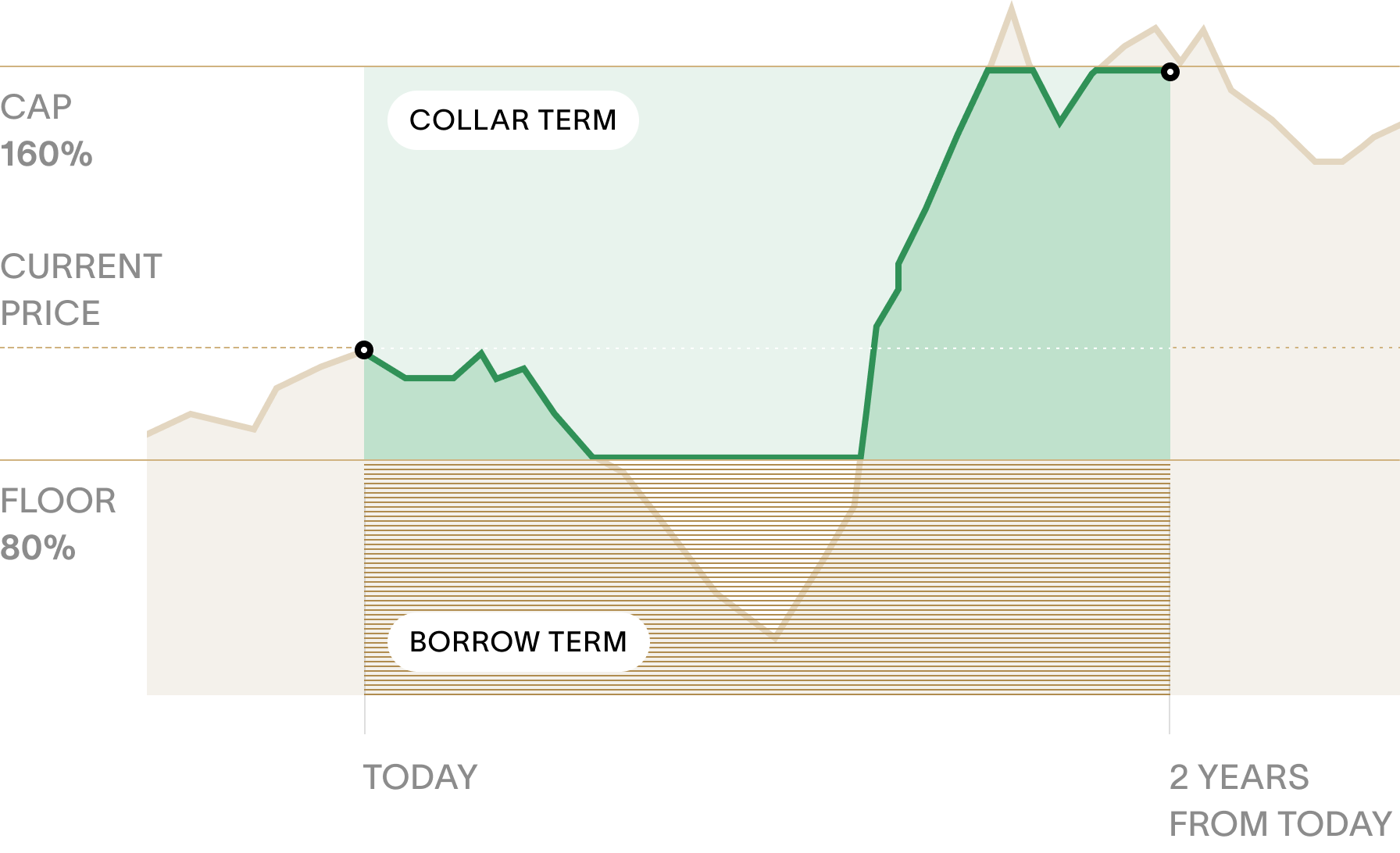

How Collar Advance works

Collar Advance is a way to get upfront cash in exchange for a contract to sell your stock at a later date. The contract can be structured for 2–5 years, and you may be able to roll it forward until you’re ready to sell.

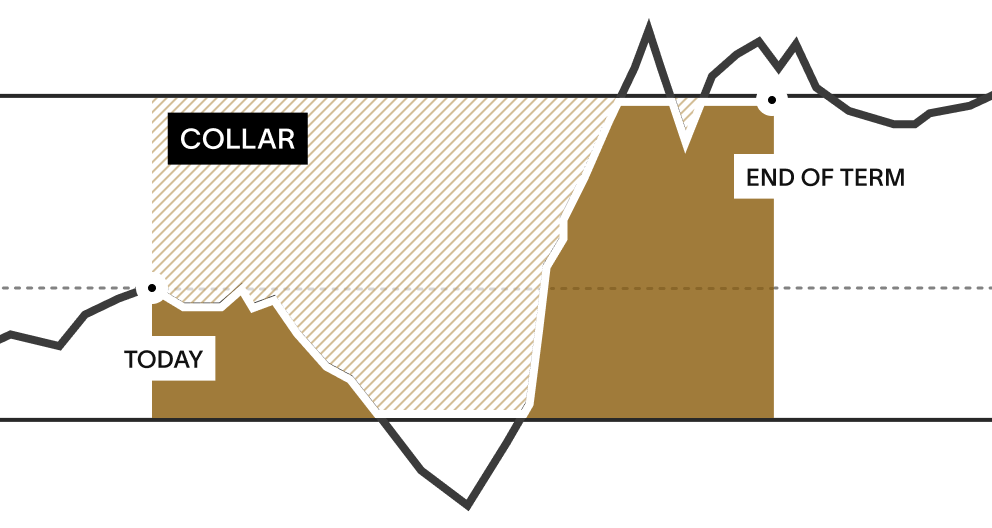

Example of a 2-year collar with 80% floor and 160% cap

CAP

160%

CURRENT

PRICE

FLOOR

80%

Today

2 YEARS FROM

TODAY

Define your protection

You select a downside "floor" to define how much protection you want. Based on market conditions, a corresponding upside "cap" is set. This creates a safe range for your stock value. Because the floor protects the collateral, you will never face a margin call, even if the stock crashes.

For example: With a 2-year 80% – 160% collar, you are protected against any drop below 80% (limiting your max loss to 20%). In exchange, you participate in all upside growth up to 160% for the next two years.

If your holding goes down in value, you won’t face a margin call.

Unlock maximum liquidity

Because your position is protected, we can advance significantly more cash than a standard bank loan. In this case, up to 80% of the stock value, minus interest fees and expenses.

Through our strategic partners, a blind auction is run across multiple banks to help ensure you get the most competitive fixed rate.

Why choose Cache

Specialists in concentrated equity

Our entire platform is engineered specifically for the unique needs of people holding concentrated stock.

Trusted with $1B+ in platform assets

We help hundreds of founders, executives, and employees manage their wealth. We bring the operational maturity required to handle large, complex positions reliably.

The "Blind Auction" Advantage

Through our strategic relationships, we make banks compete for your business. Our blind auction model collects submissions from multiple banks to get you competitive rates.

Accessible minimums

Historically, these structures were often reserved for clients with $10M+ positions. Our platform brings the entry point down to ~$1M, making the strategy accessible to more investors.

Common questions

The Basics

(X)

What is a Collar Advance and how does it work?

Who is this for, and what are the minimums?

How much can I borrow?

How safe is it? Do I face margin calls?

What does it cost, and how does it compare to margin or a mortgage?

How long does a Collar Advance last, and what happens at the end?

What can I use the money for?

How does this compare to selling my stock?

How does this compare to a margin loan?

What is the timeline? How long does it take?

Which stocks are supported?

Will this trigger taxes right now?