Why Savvy Advisors Lead with Tax Strategies

That wasn’t an isolated case. Over the past six months, I’ve had hundreds of conversations with investors who found Cache through AI searches, a friend’s referral, or one of your competitors. By the time an advisor got involved, the opportunity to lead with a proactive tax strategy had already slipped away.

Savvy advisors know the real differentiator isn’t tools or products. It’s bringing clients strategies they didn’t even know existed. One of the most powerful: helping them diversify without triggering a tax bill.

Few situations create more urgency than concentrated stock positions. The risks are high, the tax bill from selling can be overwhelming, and most clients are unaware of alternatives. Leading with tax-smart strategies not only helps clients preserve more of their wealth, but also builds trust, sparks referrals, and creates powerful prospecting opportunities by demonstrating immediate value.

The Concentration Risk Problem

Concentration risk is everywhere. Senior executives at leading tech and growth companies often have the majority of their wealth tied up in a single stock. At the same time, selling comes with a massive tax hit. For years, due to capacity constraints and qualification limitations, advisors had few options to solve this problem.

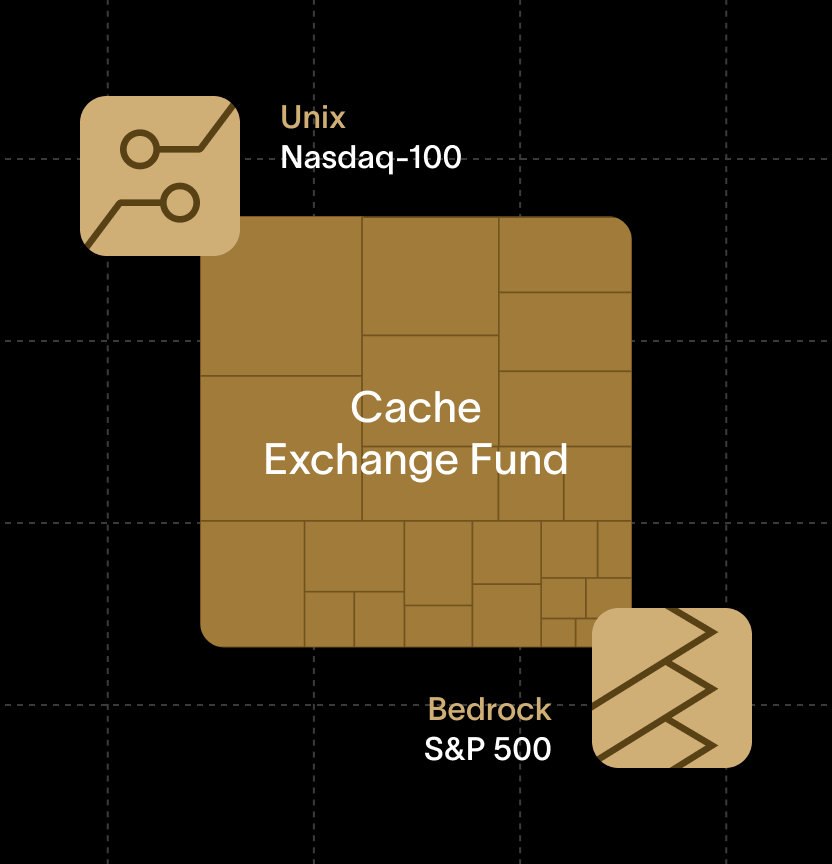

Cache changes that. We allow clients to contribute appreciated stock and receive shares in a diversified fund, benchmarked to the Nasdaq and S&P 500 indices. Importantly, no immediate taxes are triggered. Capital gains are deferred, giving clients both risk management and tax efficiency.

Proactive and Referable Advice

Clients expect proactive advice. Top advisors introduce new strategies before clients even think to ask. By starting the conversation about exchange funds, you:

- Strengthen trust with existing clients by showing foresight

- Differentiate from competitors who haven’t raised the topic

- Unlock referrals as clients naturally share novel strategies with their peers

"I discovered Cache while researching tax strategies on ChatGPT. I had previously asked my financial advisor about diversification options, but he never mentioned that something like this existed."

Senior Business Planner @ Microsoft

Demonstrating Value in Dollars and Sense

The value isn’t just theoretical. Take a $1M concentrated stock position with a $100K cost basis. For a client in a high-tax state, selling could trigger $300K+ in taxes immediately. That’s paying for your advisory fees many times over — a powerful way to demonstrate value.

“Cache has broadened access to a product that has historically been exclusive, expensive, and unable to accept our client assets. It’s a huge addition to our concentrated position playbook.”

Eric Franklin, CFP®, Founder, Prospero Wealth

A Strategy That Keeps Clients Talking

This isn’t just about diversification, it’s about positioning your service. Advisors who embrace tools like Cache are showing clients they are forward-thinking, tax-aware, and proactive.

By sharing this strategy, you:

- Help clients manage concentrated risk

- Deliver tax-smart solutions

- Stand out from competitors

- Create stories clients repeat to friends and colleagues

Will They Hear It From You First?

Opportunities like this don’t appear every day. “Diversify without a tax bill” is a message that resonates with clients, and it’s one you want associated with your practice — not with someone else’s.

👉 Take the next step: Log in to the Advisor Portal to check real-time capacity for your clients’ stocks and start the conversation today.