What’s an exchange fund?

If you’ve accumulated a lot of stock in one company, you’ll eventually face some tough tradeoffs. You could sell the stock to diversify your holdings, but it might mean incurring a big tax bill. Or you could hang onto the stock, but you’d have to ride the daily rollercoaster of having your net worth tied to one asset. Exchange funds give you the best of both worlds. They let you diversify your portfolio and defer a considerable tax bill.

It’s simpler than you may think. In a few minutes, you’ll know everything you need to know about exchange funds and how they can help you build a healthier portfolio.

What exactly is an exchange fund?

Exchange funds take stocks from multiple investors and pool them into a single fund, giving each investor a stake in the fund. As an investor, they allow you to diversify your holdings without selling stock and triggering a taxable event.

Exchange funds are not new; they’ve been used to reduce concentration risk tax-efficiently since the 1930s. Until recently, however, these funds have only been available to ultra-wealthy investors through white-shoe investment banks. They are also known as swap funds because they allow investors to “swap” a concentrated position in one stock for a diversified portfolio.

A typical exchange fund consists of stocks contributed by its investors and at least 20% “qualifying assets” (like real estate) that are required by the tax code. Exchange funds are often structured to target a particular investment objective, like well-known market indexes. For example, the Cache Exchange Fund is designed to approximate the long-term performance of the Nasdaq-100 index.

How does an exchange fund work?

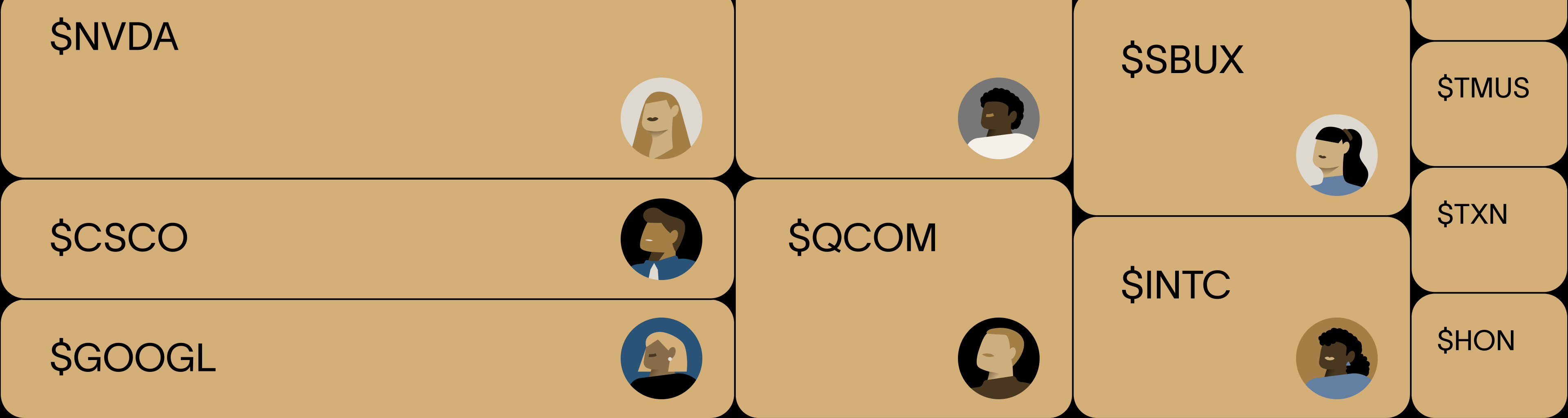

Let's look at an example to show how an exchange fund can benefit investors. Imagine there are four long-time employees of tech companies who have earned highly appreciated stock:

We used a small number of investors here to make this example simple, but exchange funds typically include a much larger portfolio that’s designed to meet an investment objective.

Now, imagine that these investors pooled their holdings to create an exchange fund. If they participated in an exchange fund together, they would be able to defer capital gains taxes while diversifying away from their appreciated positions.

Instead of individual stocks, each investor would own a share of the fund that’s proportionate to their initial contribution:

The tax benefits of exchange funds come from Section 721 of the Internal Revenue Code, which allows investors to defer the recognition of a taxable gain or a loss when they contribute stocks to a partnership. As long as certain conditions are met (like holding at least 20% of the fund in qualifying illiquid assets), no taxes are triggered when stocks are contributed to an exchange fund. Stocks are merely swapped for ownership in the fund, and each investor’s cost basis remains the same.

And each investor’s share of the fund remains the same, regardless of the performance of the stock they contributed. They are now invested in that fund instead of the underlying stock.

To receive tax-deferred treatment, the current tax code requires investors to hold their investment in the fund for seven years before they can withdraw their diversified basket of stocks. And when it comes time to sell those stocks, the initial cost basis will still apply. That means, for example, that Andrea’s $100,000 cost basis would ultimately be used to calculate her capital gains.

This is a simple illustration, but if you want to dive deeper into historic, regulatory, and technical aspects of exchange funds, check out our detailed guide that covers how exchange funds work.

What are the benefits of an exchange fund?

By helping you take your winnings off the table without triggering capital gains taxes, exchange funds can help you:

A closer look at the tax benefits of exchange funds

To really understand the tax benefits — and how tax drag can impact your portfolio — let’s return to our example. Recall that Andrea has earned $330,000 of Apple stock as equity compensation, with a cost basis of $100,000.

Here’s a hypothetical comparison between selling her Apple stock (and paying effective capital gains tax of 37.1%) versus contributing her stock to an exchange fund:

This illustration shows what happens at the starting point of the investment. With the sell-and-diversify strategy in Scenario 1, you put fewer dollars to work. While market risk is inherent to investing, the seven-year holding requirement leaves ample time for compound interest to work its magic on the larger asset pool in Scenario 2.

If Andrea’s diversified assets grow at 10% per year over that seven-year period, this is where she would end up:

At the end of the seven year holding period, participating in an exchange fund puts Andrea about 35% ahead of where she would have been if she paid capital gains taxes before diversifying. And if she were to hold onto the exchange fund for longer than seven years, the power of compound interest could keep the performance gap growing.

Here’s the full performance breakdown if Andrea earns 10% annual returns and sells after seven years (based on her 37.1% tax rate):

<div style="font-size: 18px; font-weight: 300; line-height: 1.6; font-family: Lausanne; margin-bottom: 0px; max-width:64rem;">Check out our exchange fund simulator if you want to run the numbers for an illustration of how these principles might apply to your situation. Please note that these numbers are hypothetical and not a projection or a guarantee of future performance. They involve several assumptions, which are explained in detail at the bottom of our simulator page.</div>

<div style="font-size: 18px; font-weight: 300; line-height: 1.6; font-family: Lausanne; max-width:64rem; margin-bottom: 6.4rem;"><mark>The hypothetical illustration above does not represent actual trading or reflect the impact that material economic and market factors might have.</mark></div>

Who are exchange funds for?

So, is an exchange fund right for you? It depends on your financial circumstances and whether you meet the eligibility criteria. Here are four key considerations:

1. Do you hold a concentrated position in one or two stocks?

Exchange funds can be a great way to diversify your investment portfolio if a lot of it is rooted in a single stock – especially if the stock has appreciated significantly. Are you looking for a way to reduce your risk in a tax-efficient way? And are you willing to hold the investment for at least seven years? Then an exchange fund could be a good fit for your portfolio.

Keep in mind, though, that all exchange funds (including The Cache Exchange Fund) still carry some risk, including the risk of losing principal in the fund.

2. Who is eligible for an exchange fund?

To be eligible for a modern exchange fund (like the one Cache offers), you must meet the SEC’s definition of an accredited investor, which means you must have one of the following:

- Over $200,000 in annual income OR

- Over $300,000 in annual income, when combined with a spouse or partner OR

- Over $1,000,000 in net worth (individually or with a partner), excluding the value of your primary residence

Some traditional exchange fund providers require exchange fund participants to meet the higher threshold of being a “qualified purchaser” with over $5,000,000 in investments.

Also, note that providers may only be looking for certain stocks for their funds. For example, The Cache Exchange Fund is comprised of stocks that emulate the performance of the Nasdaq-100. To meet our diversification objectives, we need to have a balanced portfolio that doesn’t include too much of any one stock. See how it works.

3. What’s the minimum contribution to an exchange fund?

Most traditional exchange fund providers require you to contribute at least $500,000 to $1,000,000 worth of a given stock to participate in their funds. The more modern Cache Exchange Fund allows contributions as low as $100,000.

4. What’s your timeline?

An investor should both intend and have the financial stability to commit for at least seven years when they decide to participate in an exchange fund.

If you need to redeem your shares in an exchange fund before seven years have passed, you’ll only be able to withdraw your original shares. Most funds also charge penalties for early redemptions, and funds have lockup periods for some period of time after the fund is initially created.

If you have a shorter time horizon, investment vehicles like a collar advance or stock lending might be a better way to take advantage of your concentrated stock position.

To qualify for tax deferral, you must stay in the exchange fund for seven years. Exchange funds are a long-term financial planning tool to help you diversify your holdings.

What are the downsides of an exchange fund?

For an investor with a concentrated position and a long-term investment approach, exchange funds have many pros. The cons of exchange funds usually apply to people who have a shorter-term time horizon or low-risk tolerance because:

- Limited liquidity: In order to benefit from the tax advantages of an exchange fund, you must hold it for seven years. Redeeming before this timeframe negates the purpose of using one. However, note that you could borrow against your fund shares if you need liquidity – keeping in mind that borrowing against fund shares entails additional risks.

- Investment constraints: An exchange fund is a passive investment vehicle designed to provide diversified exposure around a particular investment objective. Generally, exchange funds do not sell contributed stocks due to adverse tax consequences, so it may not be possible to rebalance the portfolio as aggressively as other investment vehicles like ETFs.

- Tax laws could change: The favorable tax treatment of an investment in an Exchange Fund is based on current tax laws. While the benefits may be grandfathered in under any new tax regulations, retroactive treatment is not guaranteed in the event that changes are made to tax laws.

- There is still some risk: Diversification reduces concentration risk, but it does not eliminate investment risk completely. It is still possible to lose principal when you participate in an exchange fund.

Exchange fund providers that can help you learn more

Several traditional investment banks and wealth advisors provide their clients with exchange funds or similar services — but they typically only serve qualified investors with more than $5 million in assets. Please verify eligibility and requirements with individual providers.

On the other hand, The Cache Exchange Fund offers a modern take on these funds with fewer limitations. If you hold a concentrated position of more than $100,000 in a publicly traded company, we’d love to hear from you. <a href="#" onclick="Calendly.initPopupWidget({url: 'https://calendly.com/usecache/15min'});return false;">Let us know if you have a concentrated holding and want to learn more</a>!

Disclosure

<div class="blog_disclosures-text">Material presented in this article is gathered from sources that we believe to be reliable. We do not guaranteed the accuracy of the information it contains. This article may not be a complete discussion of all material facts, and is not intended as the primary basis for your investment decisions. All content is for general informational purposes only and does not take into account your individual circumstances, financial situation, or your specific needs, nor does it present a personalized recommendation to you. It is not intended to provide legal, accounting, tax or investment advice. Investing involves risk, including the loss of principal.</div>

{{black-diversify}}